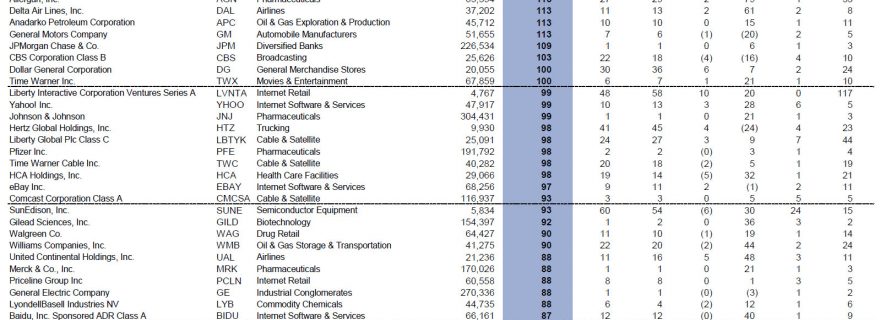

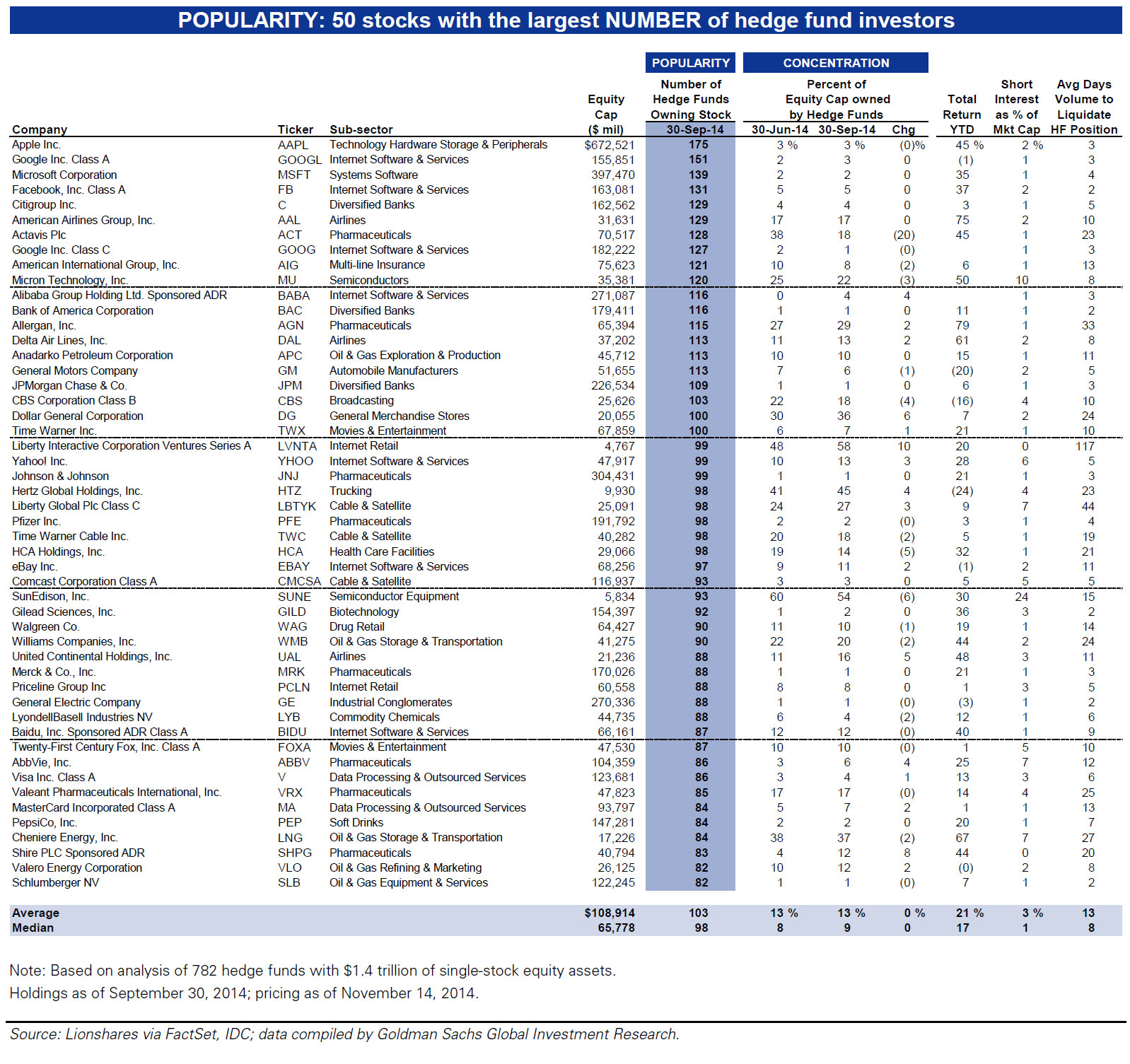

Earlier today, just after the market open, the one company that everyone had once again piled into, and which as of September 30 was the most popular company in the hedge fund community with at least 175 “smart money” institutional fans…

Click on picture to enlarge

… based on expectations that with every other stock and asset becoming increasingly illiquid, at least this one would preserve its liquidity come hell or high water, flash crashed.

The company is Apple, and its ongoing intraday weakness is also the primary reason for the Nasdaq's underperformance.

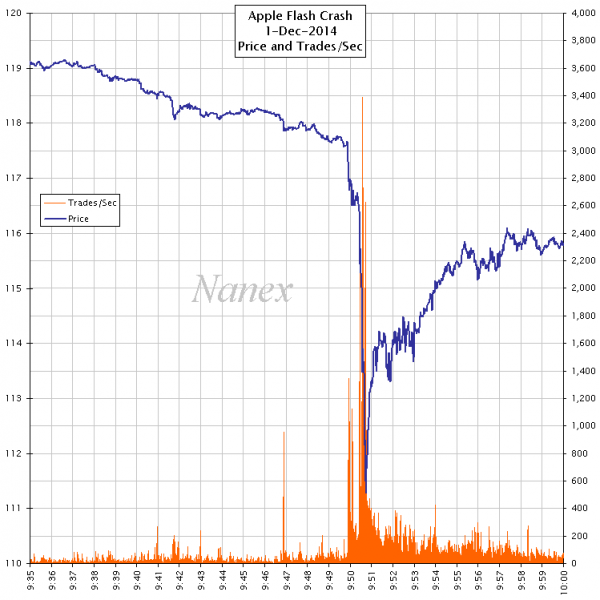

So what happend? Between 9:49:54 and 9:50:43 Eastern, (AAPL) plunged from nearly 6%, from $117.69 to $111.27, a moved which wiped out about $35 billion or one American Airlines (or one Transcanada, or one Travelers, or one Lukoil, or one Carnival, or one Christian Dior, or one Hyundai Motor Company, or one Takeda, or one State Street) in market cap.

As the following chart from Nanex shows, in today's latest flash crash, the one thing that sent the company plunging was that like in most other flash crash instances, suddenly out of nowhere, a surge in sell orders hit the tape, with some 3,400 trades taking place every second, and sending the stock plummeting.

Will the SEC lift a finger to figure out how it was possible that such dramatic repricing on no news could happen? Of course not: as if by magic, the stock managed to re-levitate following its crash and most holders can pretend that just because there was another V-shaped recovery, what happened never actually happened.

Until one day, like Carl Icahn warned, the recovery part will never arrive. Then it will be too late to demand answers from the SEC.

In the meantime, remember what we said up front: increasingly more managers are piling into AAPL because it has the reputation of the “most liquid” stock in the market. Well, the “most liquid stock” just flash crashed.