AUD/USD Forecast Apr. 16-20 – A Bit Overbought, Jobs In The Limel...

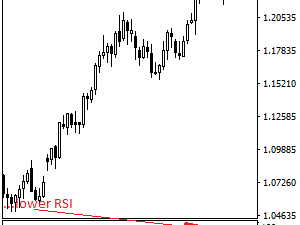

The Australian dollar advanced nicely as trade came back to fashion once again. The upcoming week features the RBA minutes, Australian jobs and the Chinese GDP. Here are the highlights of the week and an updated technical analysis for AUD/USD. Australia needs flowing trade to flourish. After China and the US moved from trade wars to pleasantries,…