Gold Sinks As U.S. Dollar Resumes Rally

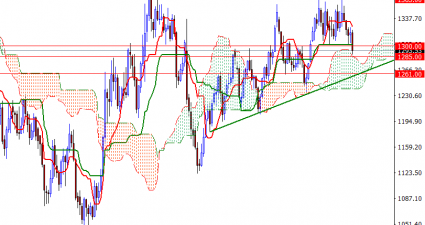

Gold prices ended Tuesday’s session down $22.63 an ounce, extending losses to a third straight session, as rising bond yields and a strong U.S. dollar abated investor appetite for the precious metal. The dollar index surged to a five-month high on the back of upbeat U.S. economic data. XAU/USD broke below the support in the…