Thoughts

3 am: Small cap stocks continue to lead large cap stocks. A medium term bullish sign for the stock market.

Small cap stocks (Russell 2000) led the stock market higher from February – present.

Despite rallying the most, small cap (Russell) fell the least during yesterday's stock market pullback (small cap was almost unchanged while large cap fell). This is a sign of bullish price action and suggests that the leaders (small cap) continue to lead the stock market higher.

I predicted a pullback yesterday, and I don't think this pullback will last long in terms of TIME.

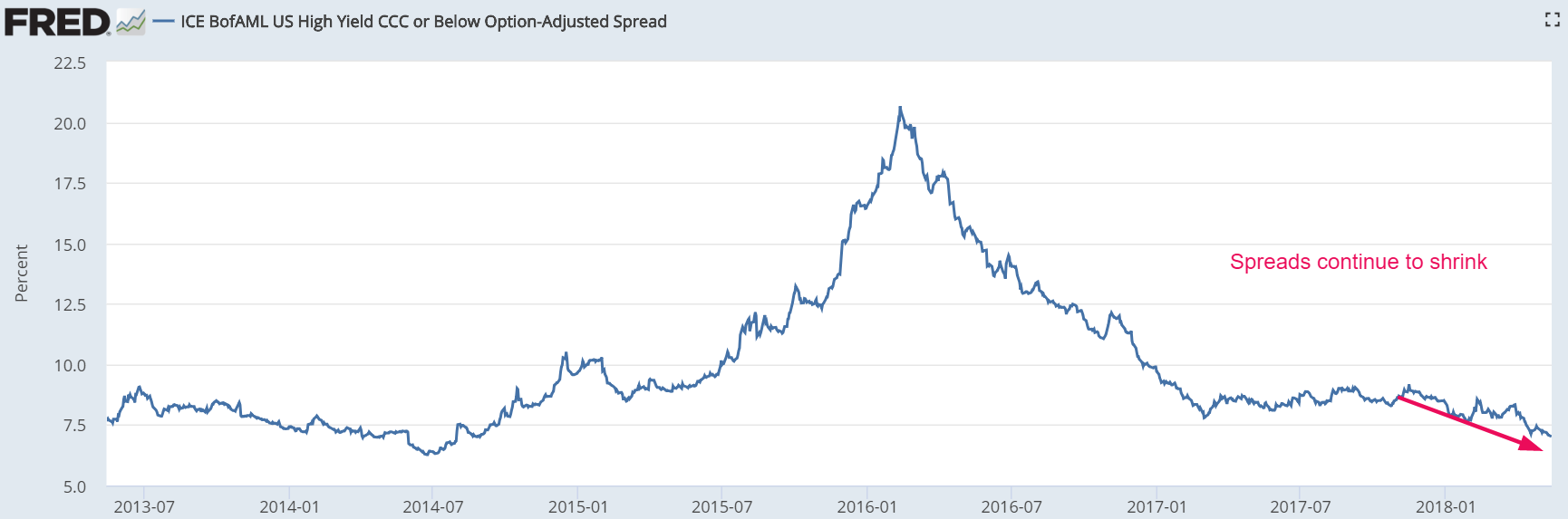

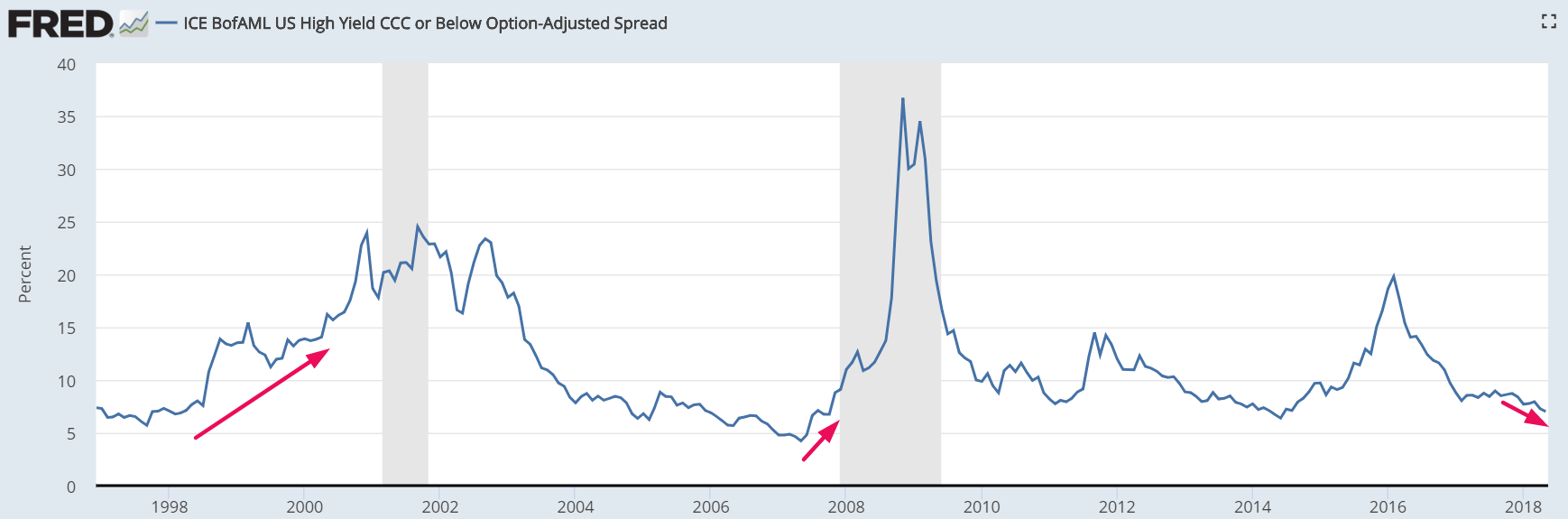

3 am: High yield spreads continue to make new lows. A medium-long term bullish sign for stocks.

High yield spreads continue to make new lows despite the stock market's correction from January 2018 – present.

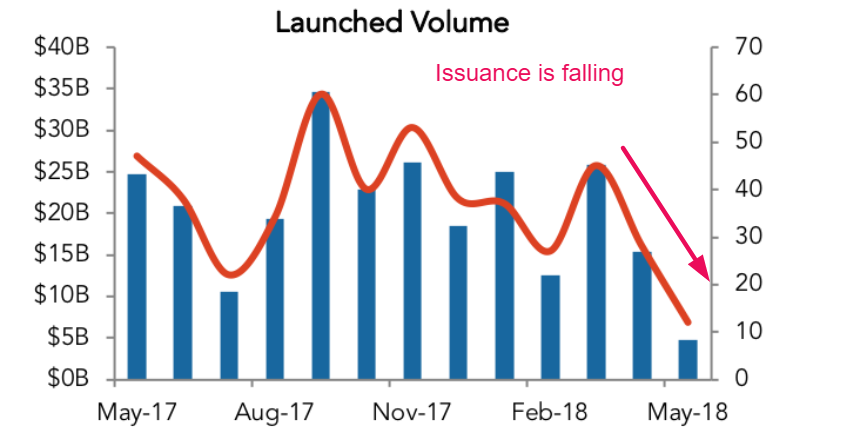

This is partially because high yield issuance (new supply) has declined.

This is a medium-long term bullish sign for the stock market and suggests that January 2018 wasn't the stock market's top. Bond market participants are smarter than stock market participants, which is why the bond market is a leading indicator for the stock market. Historically, high yield spreads widen before a bull market tops.

1 am: Retail Sales growth: this bull market in stocks still has 1-2 years left.

Retail Sales increased 0.3% month-over-month (up 4.7% year-over-year). More importantly, the year-over-year growth in Retail Sales is still trending higher.