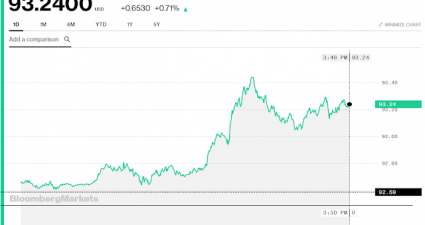

WTI/RBOB Drop After Another Surprise Crude Build

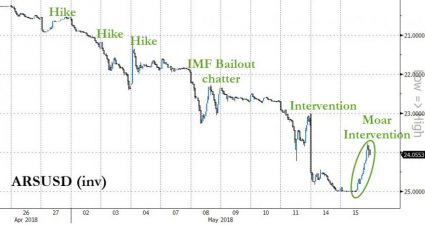

After clinging to the green all day, despite a strong dollar, WTI/RBOB slipped into the red after API reported a much bigger than expected (and surprise) crude build (+4.854mm vs -1.75mm exp). API Crude +4.845mm (-1.75mm exp) Cushing +62k (+550k exp) Gasoline -3.369mm Distillates -768k After drawing down last week, expectations were for crude draw…