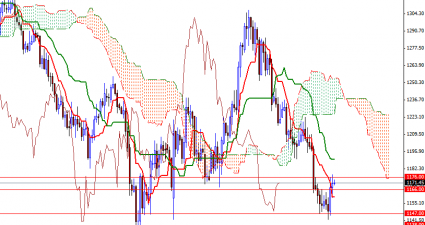

Gold Touches Two-Week High

Gold prices settled higher yesterday, extending gains from the previous session, on increasing views the pace of rate hikes is likely to be slower than previously expected. The U.S. central bank not only downgraded its economic growth and inflation projections at its latest meeting but also lowered its interest rate trajectory. Fed officials expect the…