If admitting you have a problem is the first step toward recovery, then China is making progress. The question is progress to what, because the generic answer, “another debt-fueled boom” is no longer applicable. Recall that as we noted here initially in the summer of 2013, the very reason why China finds itself in a reformist quandary is that the traditional method of Chinese “growth” – issuing a little under $4 trillion in aggregate system debt per year – no longer works as the bad debt portion of the Ponzi scheme is rising at a faster pace than the total notional of debt itself.

Which means the PBOC, which cut rates for the first time in two years on Friday, will have its work cut out for it. And in the worst tradition of “developed world” banks, Beijing will now have no choice but to double down on the very same bad policies that got it into its current unstable equilibrium, and proceeds with a full-blown policy flip-flop, leading to a full easing cycle that reignites the bad-debt surge once more.

And sure enough, today Reuters reports citing “unnamed sources involved in policy-making” (supposedly different sources than the unnamed sources Reuters uses to float trial balloons used by the ECB and the BOJ), that “China's leadership and central bank are ready to cut interest rates again and also loosen lending restrictions” due to concerns deflation “could trigger a surge in debt defaults, business failures and job losses, said sources involved in policy-making.” In other words, China has once again looked into the abyss once… and decided to dig a little more.

The story is well-known: “Economic growth has slowed to 7.3 percent in the third quarter and policymakers feared it was on the verge of dipping below 7 percent – a rate not seen since the global financial crisis. Producer prices, charged at the factory gate, have been falling for almost three years, piling pressure on manufacturers, and consumer inflation is also weak.”

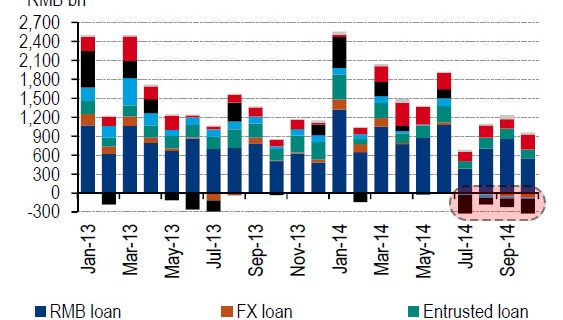

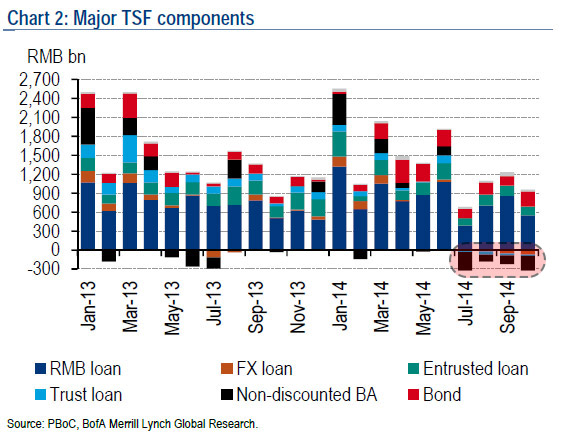

Of course, in modern economics, deflation simply means deleveraging, which as we showed last weekend, is precisely what is happening to China's shadow banking sector every month in the prior quarter.

And so, since deleveraging in China, which at least on goalseeked paper is growing a little over 7%, the Polibturo has no choice but to join all the other central banks in going all in on stimulative monetary policy.

today Reuters reports :

“Top leaders have changed their views,” said a senior economist at a government think-tank involved in internal policy discussions.

The economist, who declined to be named, said the People's Bank of China had shifted its focus toward broad-based stimulus and were open to more rate cuts as well as a cut to the banking industry's reserve requirement ratio (RRR), which effectively restricts the amount of capital available to fund loans.

“Further interest rate cuts should be in the pipeline as we have entered into a rate-cut cycle and RRR cuts are also likely,” the think-tank's economist said.

Friday's move, which cut one-year benchmark lending rates by 40 basis points to 5.6 percent, also arose from concerns that local governments are struggling to manage high debt burdens amidst reforms to their funding arrangements, the sources said.