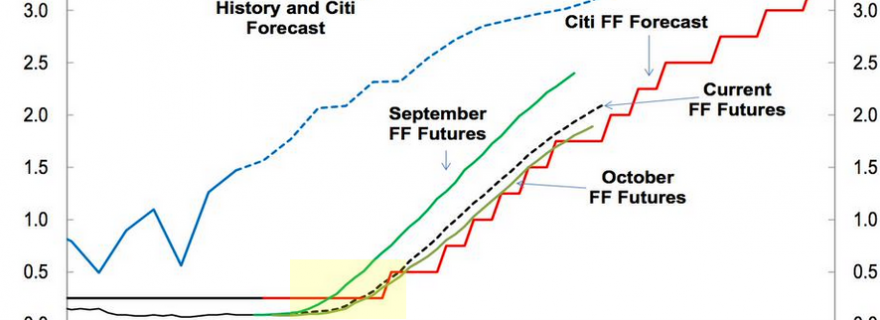

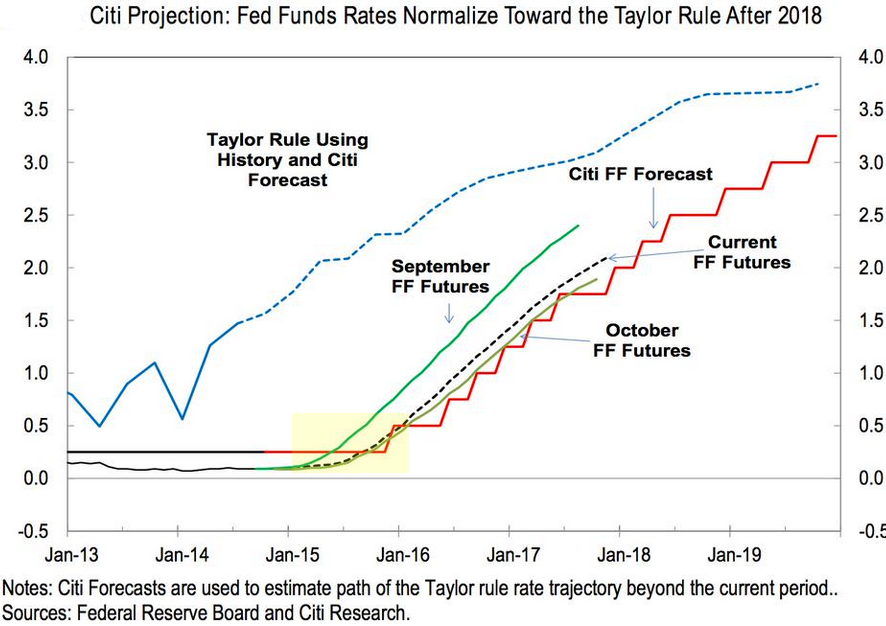

The latest Reuters poll is showing 24 out of 43 economists projecting the first rate hike in the U.S. by June of next year. The futures market is pricing lift-off by September. Citi's latest analysis puts it in December. And all of these forecasts are running way behind the so-called Taylor Rule, which suggests that the Fed Funds rate should already be at 1.5%.

Source: @Schuldensuehner, Citi

In fact the U.S. economy can easily handle non-zero short-term rates at this point. The banking system is quite healthy and can easily manage funding costs of 1.5%. Corporate borrowers can deal with slightly higher rates as well. And as far as mortgages are concerned (to the extend higher short-term rates extend to longer maturities), borrowers for whom payments become prohibitive at 5% vs. 4% should not be taking out a mortgage to begin with. Furthermore the issue with the housing market these days has more to do with tighter mortgage credit rather than rates.

But it's no longer as much about the U.S. economy as it is about external factors. The international situation has made the Fed's policy planning much more complex. The monetary policy divergence among the major central banks is the issue at hand. With the BoJ suddenly accelerating its QE program, the PBoC cutting rates, and Mario Draghi hinting at a potential QE program in the Eurozone, the Fed is becoming increasingly isolated in its plans to begin rate normalization. Even India's RBI, who has kept rates elevated for some time, may begin to ease soon as the nation's inflation and money supply growth slows.

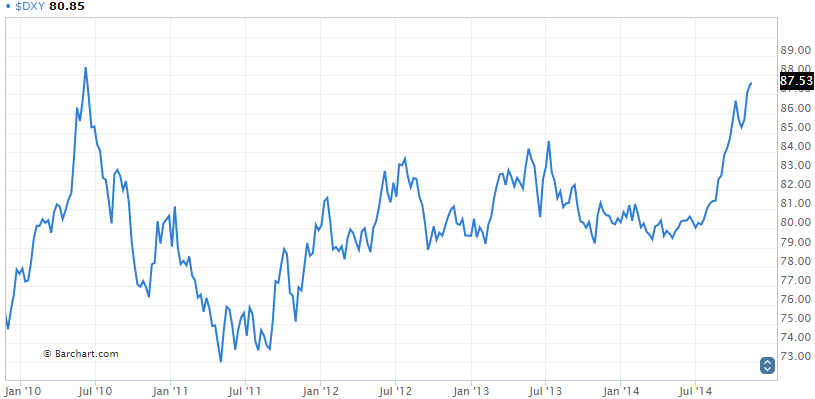

As a result of this divergence, the U.S. dollar has been on the rise this year.

Of course the recent increase in and of itself is not tremendous relative to historical levels. However, given the disinflationary pressures around the world, the rising U.S. dollar effectively “imports” disinflation into the U.S. Moreover, the massive drop in energy prices, caused by a combination of a significant rise in North American production and weaker demand globally (as well as the Saudi “dumping“), is adding to slower inflation. In fact, in recent months a paradigm shift has taken place. Weakness in inflation is no longer viewed as a temporary phenomenon and longer-dated inflation expectation measures have turned sharply lower.