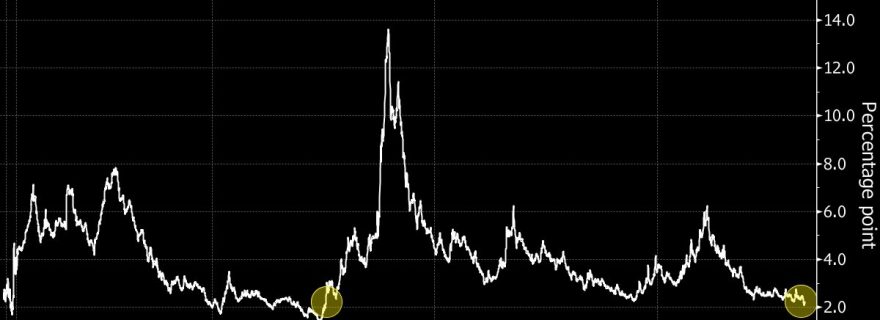

There has been a huge increase in corporate debt to record levels, but the cost to service the debt is manageable because interest rates are low and investors are extremely sanguine. As you can see from the chart below, the spread between junk bonds and investment grade bonds is the lowest of this business cycle. This means that the additional risk taken out by investors buying junk bonds is being rewarded with historically little premium.

Source: Bloomberg

Investors are in a ‘risk on' mode. It's easy to say that junk bonds are probably a poor bet versus investment grade bonds on a risk adjusted basis, but there can still be extremely speculative money made in junk if this cycle continues unabated (not for beginners). The spread was tight in early 2017, yet nothing has happened since then to widen it. If the spread were to widen, firms with junk debt would face the wrath of higher borrowing costs causing some of them to go under.

Leveraged Firms Will Be Squeezed In A Stress Period

Bankruptcy risk isn't the only risk faced by increasing rates. Firms which take out investment grade debt are highly unlikely to go bankrupt, but higher interest rates make the excess leverage taken out look like a mistake. The debt rate is locked in after its issued, but when it's rolled over, it can be painfully expensive to pay the new higher rates. The pain will be widespread when this occurs because debt is so excessive. It will be tougher to make M&A deals, pay dividends, buyback stock, invest in capex and in new initiatives. The best time to make M&A deals and buyback stock is when asset prices are cheap during stress periods, so foregoing that ability is a big opportunity cost. It's difficult to finance deals in moments of panic which is why having a big horde of cash is advantageous.

When evaluating leverage, there are both positives and negatives. Taking out debt has increased returns for years, but it will be a problem during the next recession. It's very difficult for firms to time cycles as they are mainly adept at running their businesses, not timing the cycle. This isn't an excuse for malinvestment at inopportune cyclical moments, but it is a sad reality. There will be firms which take advantage of the stress periods, but in aggregate, there will be pain. To be clear, we aren't expressing a negative view on the near term economy, but it's fair to review the potential risk factors in the corporate debt market when the economy is healthy; it's good to issue reminders about the potential positives when the economy is in a recession. It's up to you as the investor to take those signposts and use them to accurately time the market. An article for general consumption will never be able to tell you the correct decision for your portfolio. The purpose of the discussion is to allow you to see various perspectives and to give you the tools to evaluate for yourself.