–>

-

ALSO READ

Neighbours, Russia can help convert 16.38% of India's trade into rupees

RBI's e-rupee pilot takes off; Day 1 bond trade deals hit Rs 275 crore

Google may face a third CCI fine in less than a month. Now for android TV

Top Headlines: CBDC rollout this FY, banks deal with sanctioned entities

Not in a hurry to launch CBDC; have to proceed carefully: RBI Guv Das

-

–>

–>

The Reserve Bank of India's (RBI's) pilot project for its central bank Digital Currency trades in sovereign bonds has gained steam, with volumes registering an almost double-fold increase so far this week.

The RBI launched the pilot for trading in the secondary market for government bonds using its CBDC – or the wholesale ‘e-rupee'- on November 1.

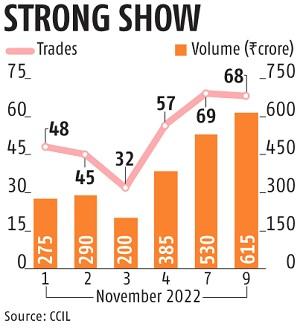

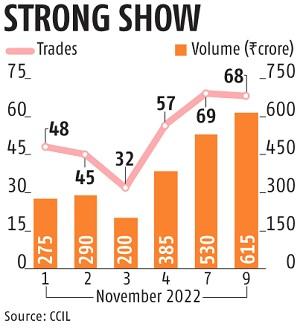

According to data provided by the Clearing Corporation of India Ltd (CCIL), the CBDC bond trades last week averaged at Rs 287.5 crore on a daily basis. So far in the current week, the trades have averaged 99 per cent higher at Rs 572.5 crore.

Trades worth Rs 530 crore were struck on Monday using the CBDC while those worth Rs 615 crore were carried out on Wednesday — the highest so far. The total regular trade volume in government securities was at Rs 25,435 crore on Wednesday.

In the previous week, the number of trades struck on a daily basis averaged about 45. That number, too, has gone up sharply this week, with 69 trades being struck on Monday followed by 68 trades on Wednesday. The bond market was shut on Tuesday on account of Guru Nanak Jayanti.

A bulk of the CBDC transactions have been carried out in two of the most liquid securities in the market – the 10-year benchmark 7.26 per cent 2032 bond and the five-year 7.38 per cent 2027 bond.

According to the RBI's announcement on October 31, nine banks have been selected to participate in the pilot project. The banks are SBI, Bank of Baroda, Union Bank of India, HDFC Bank, ICICI Bank, Kotak Mahindra Bank, YES Bank, IDFC First Bank and HSBC.

Market sources said all these banks had been carrying out transactions using the CBDC on a daily basis. A key point made by the RBI in its announcement launching the pilot was that settlements in central bank money would reduce transaction costs by pre-empting the need for a settlement guarantee infrastructure or for collateral to mitigate settlement risk.

Unlike the regular trades in government bonds, the settlement of securities in CBDC transactions are not conducted by the CCIL.

Illustration: Binay Sinha

In regular bond market trades, the CCIL acts as the clearing house and the settlements of bonds are on a T+1 basis which means that settlement of securities must happen a day after the transaction is carried out.

However, for trades using the digital currency, there is no settlement authority like the CCIL and trades happen on a T+0 basis, implying real-time settlement. Furthermore, banks using the digital rupee must open primary CBDC accounts with the RBI.

The central bank views the use of the digital rupee as a step towards making the inter-bank market more efficient. The sovereign bond market is the pricing benchmark for a vast variety of credit products in the economy.

The RBI will launch its first pilot for digital rupee trading in the retail segment this month in select locations. The retail use of the digital rupee would be within closed user groups comprising customers and merchants.

“Things are running smoothly so far. This is going to be used more as a test case to ensure RBI gets its systems right in running CBDC,” said a senior treasury official from a private sector bank. “There are no glitches so far as this is a simple use case. It involves government bonds, and there is already a system in place. We only have to change the settlement mechanism, instead of going through CCIL it directly goes to the RBI. This is more about testing peripheral things. At some point in time RBI may ask the banks to suggest other use cases for CBDC wholesale. The sense we are getting is that they are likely to go slowly,” the official said.

The Reserve Bank of India's (RBI's) pilot project for its Central Bank Digital Currency trades in sovereign bonds has gained steam, with volumes registering an almost double-fold increase so far this week.

The RBI launched the pilot for trading in the secondary market for government bonds using its CBDC – or the wholesale ‘e-rupee'- on November 1.

According to data provided by the Clearing Corporation of India Ltd (CCIL), the CBDC bond trades last week averaged at Rs 287.5 crore on a daily basis. So far in the current week, the trades have averaged 99 per cent higher at Rs 572.5 crore.

Trades worth Rs 530 crore were struck on Monday using the CBDC while those worth Rs 615 crore were carried out on Wednesday — the highest so far. The total regular trade volume in government securities was at Rs 25,435 crore on Wednesday.

In the previous week, the number of trades struck on a daily basis averaged about 45. That number, too, has gone up sharply this week, with 69 trades being struck on Monday followed by 68 trades on Wednesday. The bond market was shut on Tuesday on account of Guru Nanak Jayanti.

A bulk of the CBDC transactions have been carried out in two of the most liquid securities in the market – the 10-year benchmark 7.26 per cent 2032 bond and the five-year 7.38 per cent 2027 bond.

According to the RBI's announcement on October 31, nine banks have been selected to participate in the pilot project. The banks are SBI, Bank of Baroda, Union Bank of India, HDFC Bank, ICICI Bank, Kotak Mahindra Bank, YES Bank, IDFC First Bank and HSBC.

Market sources said all these banks had been carrying out transactions using the CBDC on a daily basis. A key point made by the RBI in its announcement launching the pilot was that settlements in central bank money would reduce transaction costs by pre-empting the need for a settlement guarantee infrastructure or for collateral to mitigate settlement risk.

Unlike the regular trades in government bonds, the settlement of securities in CBDC transactions are not conducted by the CCIL.

Illustration: Binay Sinha

In regular bond market trades, the CCIL acts as the clearing house and the settlements of bonds are on a T+1 basis which means that settlement of securities must happen a day after the transaction is carried out.

However, for trades using the digital currency, there is no settlement authority like the CCIL and trades happen on a T+0 basis, implying real-time settlement. Furthermore, banks using the digital rupee must open primary CBDC accounts with the RBI.

The central bank views the use of the digital rupee as a step towards making the inter-bank market more efficient. The sovereign bond market is the pricing benchmark for a vast variety of credit products in the economy.

The RBI will launch its first pilot for digital rupee trading in the retail segment this month in select locations. The retail use of the digital rupee would be within closed user groups comprising customers and merchants.

“Things are running smoothly so far. This is going to be used more as a test case to ensure RBI gets its systems right in running CBDC,” said a senior treasury official from a private sector bank. “There are no glitches so far as this is a simple use case. It involves government bonds, and there is already a system in place. We only have to change the settlement mechanism, instead of going through CCIL it directly goes to the RBI. This is more about testing peripheral things. At some point in time RBI may ask the banks to suggest other use cases for CBDC wholesale. The sense we are getting is that they are likely to go slowly,” the official said.