–>

-

ALSO READ

Here is what the internet expects from Apple in its new iPhone 14 series

Apple sends invites for Sept 7 event: All about expected iPhone 14 launch

iPhone 14 launch: Here is what Apple announced in the last 5 years

Apple launch event 2022: Where to watch, what to expect? Check details

iPhone 14 series Launch: All model details, specifications and price

-

–>

–>

Apple Inc. updated its App Store guidelines Monday with new and clearer language explaining its policy toward cryptocurrency trading and non-fungible tokens.

The Cupertino, California-based company has no issue with crypto exchanges or any other apps that allow the trading of digital tokens and currencies — provided those exchanges have the requisite regional licenses to operate where the app is distributed.

But in order for apps to sell NFTs and related services, they'll have to go through Apple's in-app purchase systems and “may not include buttons, external links, or other calls to action that direct customers to purchasing mechanisms other than in-app purchase.”

The fight to funnel payments through Apple's own payment system, justified by the iPhone maker as the only sure way to secure users and their sensitive information, has spanned legal tussles with Fortnite maker Epic Games Inc. and confrontations with governments like South Korea's.

Apple charges a typical 30% fee on payments it handles, which has yielded significant income from products like Fortnite that include a lot of in-game content unlockable by deep-pocketed players.

Apple specifically guides against any app functionality that lets NFT holders “unlock features or functionality within the app,” which may have served as an oblique workaround to its payments rule. That may affect some NFT projects that use the token like a membership card, providing added perks and access not otherwise accessible.

Still, Apple will allow users to display, browse and share their NFT collection with others in apps across its iPhones and iPads.

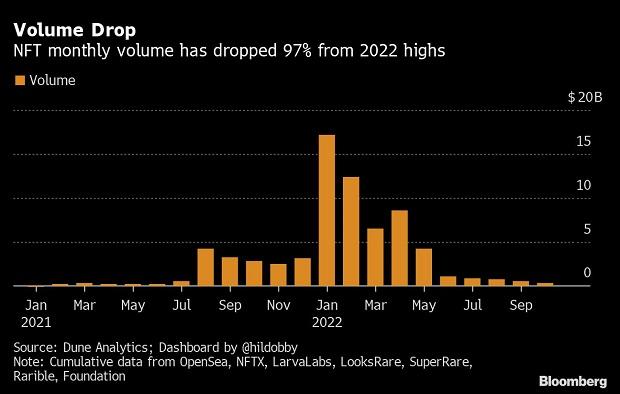

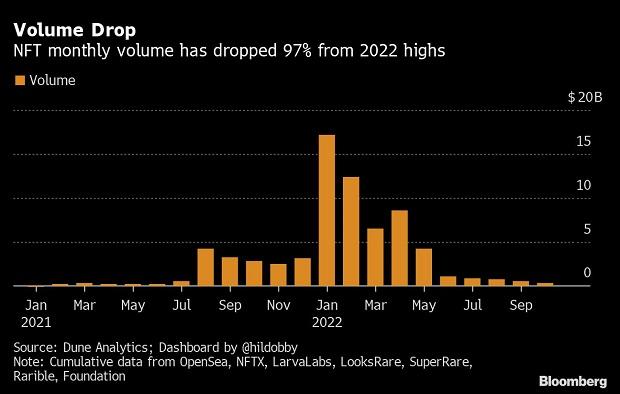

Trading volumes for NFTs — digital art and collectibles recorded on blockchains — have plummeted 97% from their January record high after a series of economic shocks and crypto sector blowups soured appetites for digital assets.

Apple Inc. updated its App Store guidelines Monday with new and clearer language explaining its policy toward cryptocurrency trading and non-fungible tokens.

The Cupertino, California-based company has no issue with crypto exchanges or any other apps that allow the trading of digital tokens and currencies — provided those exchanges have the requisite regional licenses to operate where the app is distributed.

But in order for apps to sell NFTs and related services, they'll have to go through Apple's in-app purchase systems and “may not include buttons, external links, or other calls to action that direct customers to purchasing mechanisms other than in-app purchase.”

The fight to funnel payments through Apple's own payment system, justified by the iPhone maker as the only sure way to secure users and their sensitive information, has spanned legal tussles with Fortnite maker Epic Games Inc. and confrontations with governments like South Korea's.

Apple charges a typical 30% fee on payments it handles, which has yielded significant income from products like Fortnite that include a lot of in-game content unlockable by deep-pocketed players.

Apple specifically guides against any app functionality that lets NFT holders “unlock features or functionality within the app,” which may have served as an oblique workaround to its payments rule. That may affect some NFT projects that use the token like a membership card, providing added perks and access not otherwise accessible.

Still, Apple will allow users to display, browse and share their NFT collection with others in apps across its iPhones and iPads.

Trading volumes for NFTs — digital art and collectibles recorded on blockchains — have plummeted 97% from their January record high after a series of economic shocks and crypto sector blowups soured appetites for digital assets.