The “in-coming” data turned into a blizzard of bad news today, but the Cool Aid dispensers at the New York Fed urged us not to fret—–it was all a temporary blip:

New York Fed staff economists said in a new report growth should regain some of its swagger after stumbling during a chilly first quarter…… it believes first-quarter weakness was partly due to “transitory factors,” particularly harsh winter weather and labor disputes in West Coast ports: “Consequently, the staff forecast anticipates that growth will rebound to around 2.5% annual rate over the remainder of 2015 and 2016…..”

Well, here's a wake-up call for B-Dud and staff: What you see in the graph below is what “transitory” doesn't look like. In fact, its a searing indictment of your delusional belief that the flood of money you have pumped into Wall Street is helping the real main street economy.

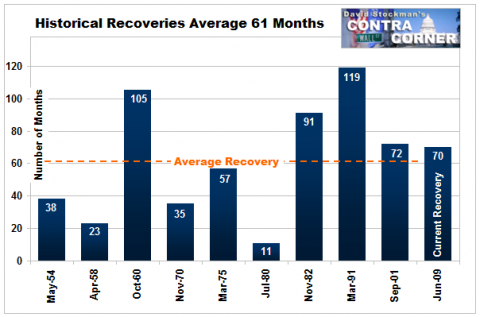

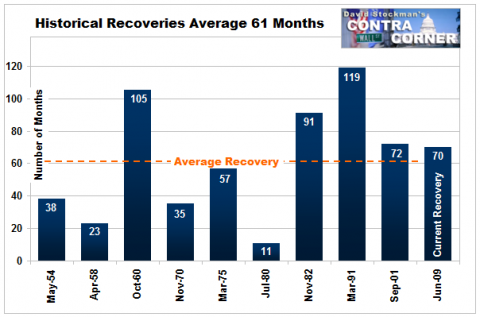

No it hasn't. The graph shows that manufacturing output growth has stalled-out since November, but also that this roll-over is by no means just a winter swoon. We are now in month 70 of the so-called “recovery”, and it has been seven and one-half years since the pre-crisis peak. Yet at its current plateau, today's “disappointing” April number for manufacturing production represents just a 0.33% annual rate of growth since December 2007.

Surely you do not really believe that the vast build-up of inventory hanging over the US economy is going to dissolve on its own accord? Or that you have actually abolished the business cycle and reinvented Bernanke's once and former Great Moderation. So this graph is a huge rebuke to your ritual optimism about the “second half”.

To wit, the recovery cycle is already long in the tooth, and there has been no trend recovery of manufacturing production whatsoever. And why would you expect it at this late hour—–when exports are faltering, the oilfield boom is over and the inventory-to-sales charts spell “liquidation” just ahead?