Albert Einstein once said compound interest was the greatest invention in human history. If Einstein were around today he would be better able to explain the magical effect of compounding, but in his absence, we are going to give it a whirl.

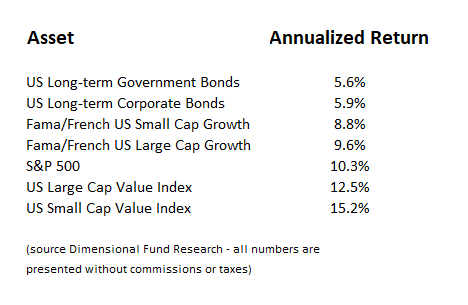

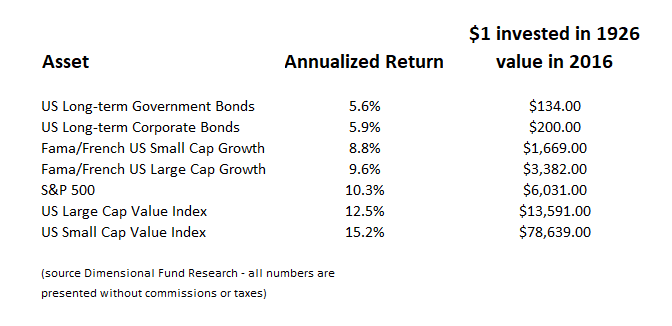

Over the last 80 years ending in 2016, according to Dimensional Fund Research, the following asset classes have returned:

What does that equate to after 80 years of compounding?

Let's start with the lowest return. $1 invested in US Long-term Government Bonds in 1926 would be worth $134 in 2016. If you had the vision to invest in the riskier Corporate Bonds, that $1 would be worth $200.

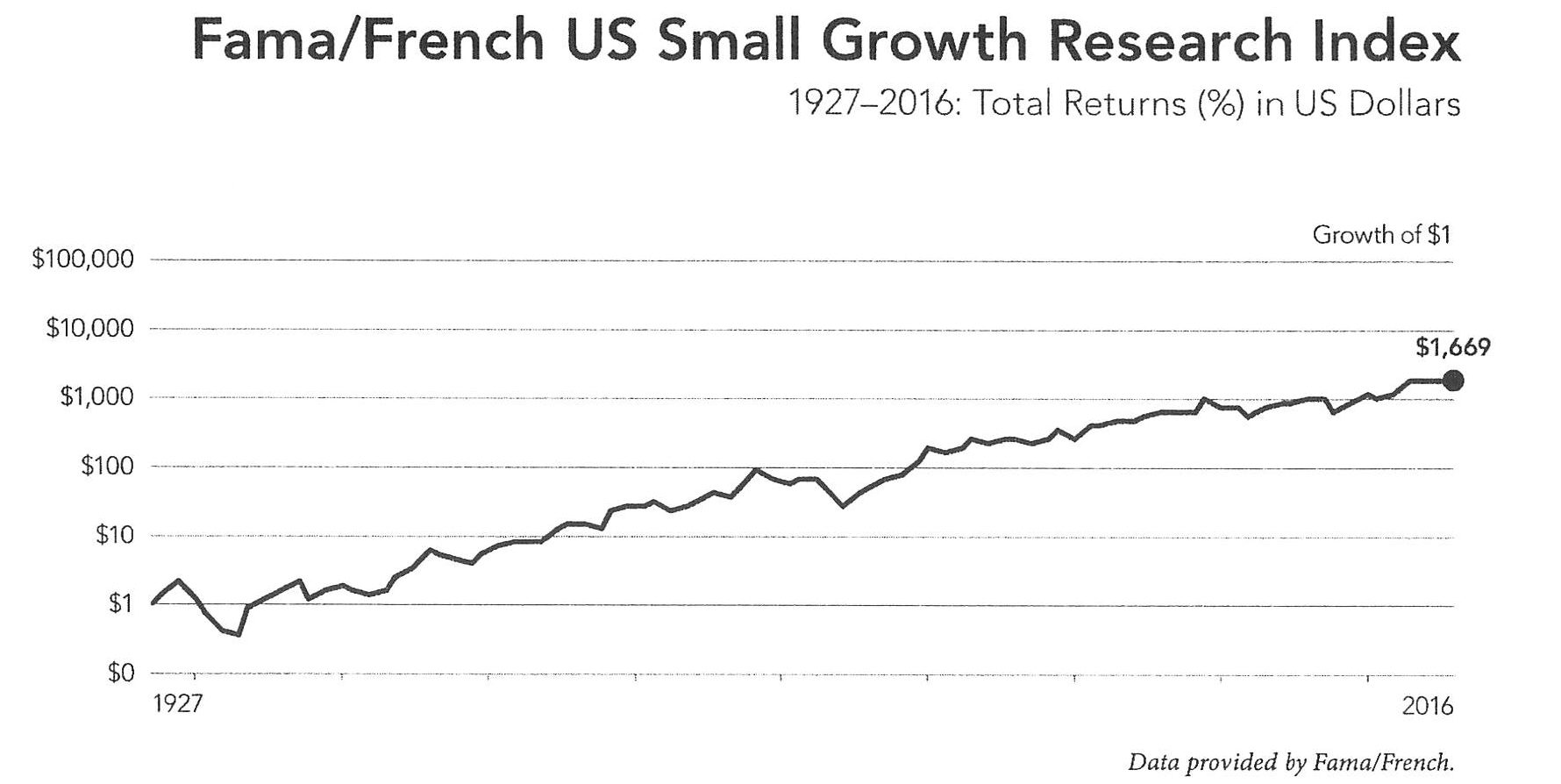

But if you had the foresight to invest in equities, it would be dramatically better. Even with the worst performing equity strategy, the Fama/French US Small Cap Growth, which averaged an 8.8% return, you would be looking at $1,669 at the end of 80 years.

That's more than eight times better than corporate bonds.

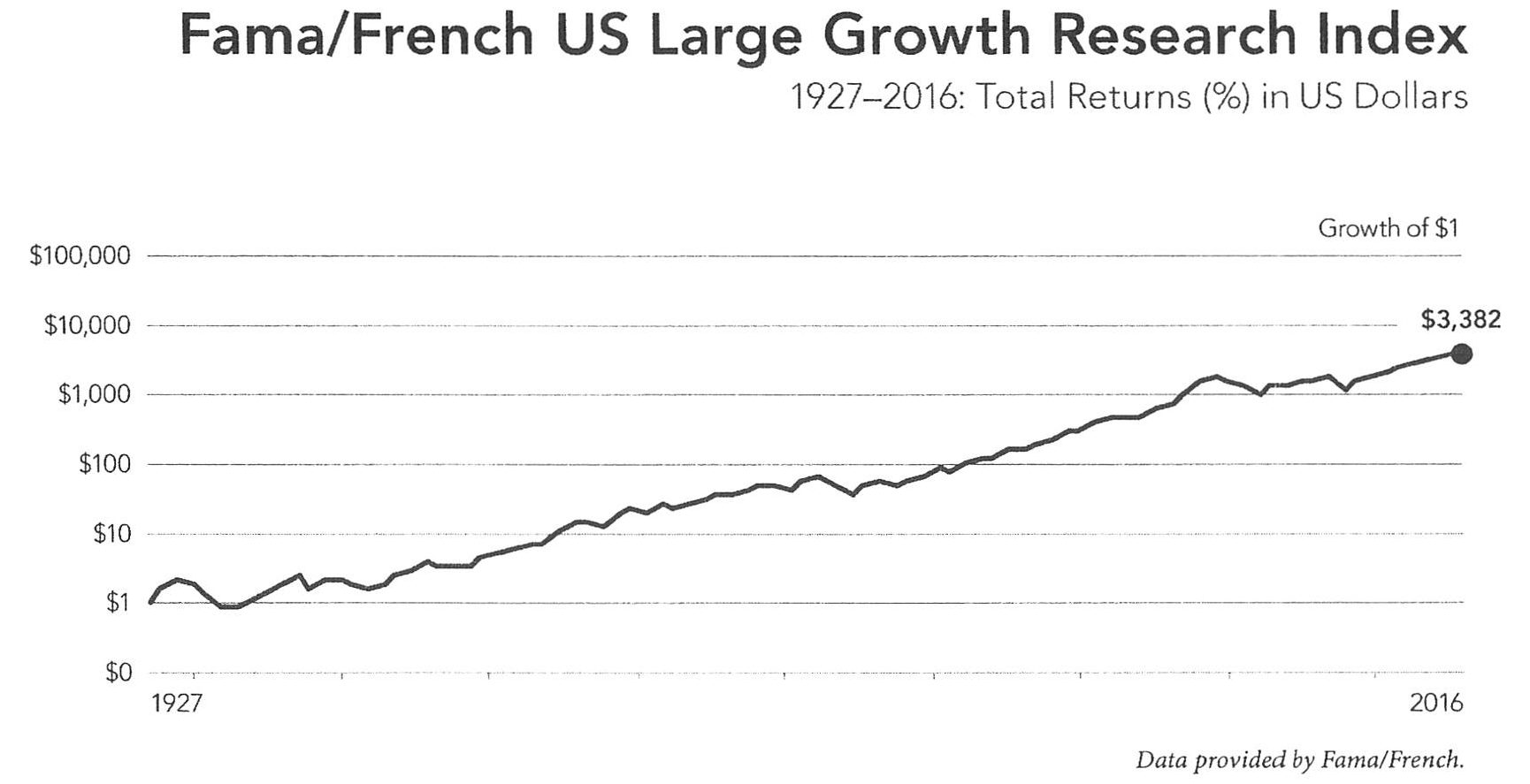

But what if we had gone with Large-Cap Growth instead? A 9.6% annualized return works out to $3,382.

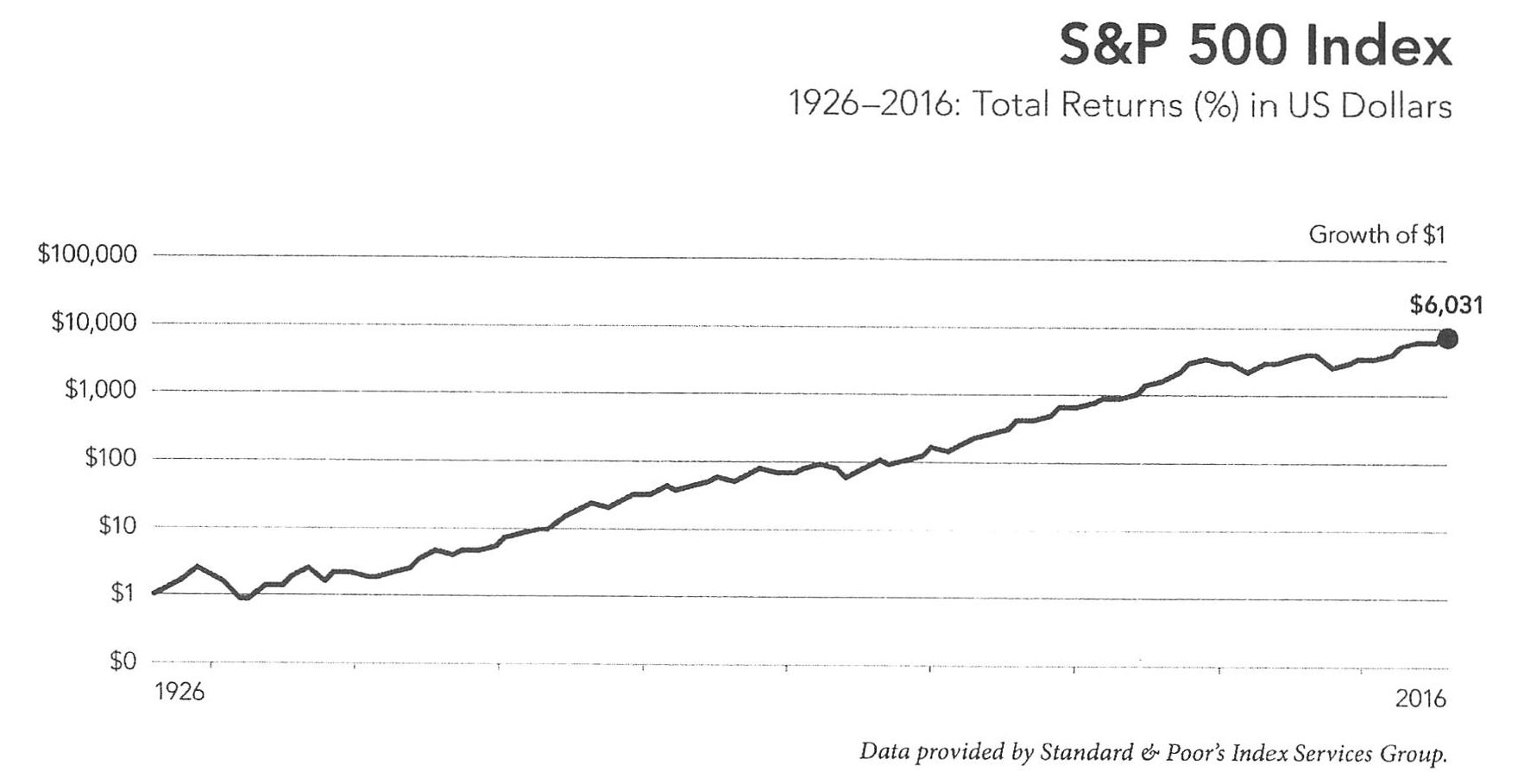

And how about the S&P 500 at 10.3%? That's $6,031 after 80 years.

Investing in the S&P 500 instead of Corporate Bonds meant 30x more money after 80 years. $6,000 versus $200 is an astounding difference.

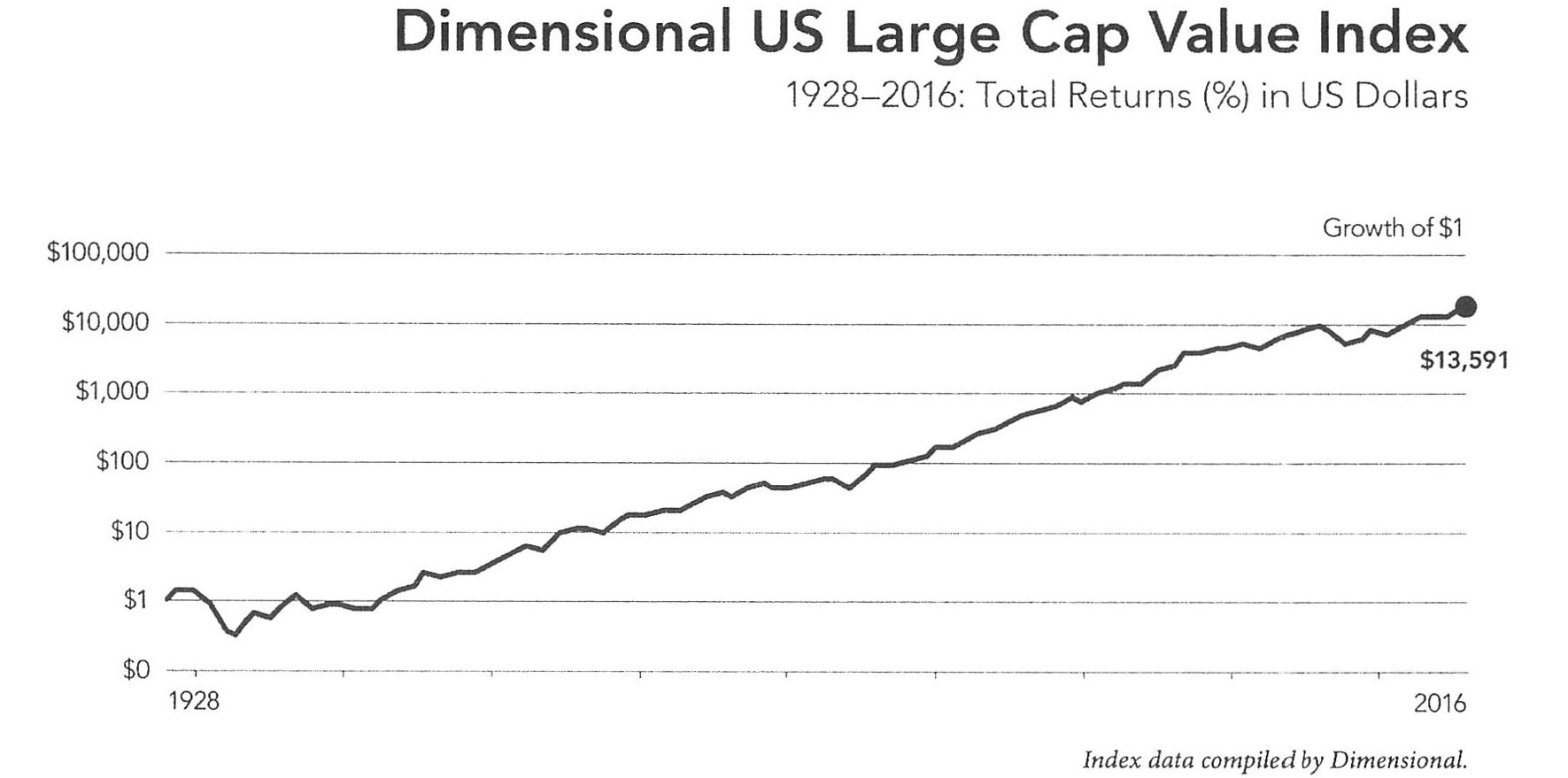

Yet this difference almost pales in comparison to these next indexes. What if instead of just blindly buying the S&P 500, we do a little work on value stocks, specifically large-cap stocks?

This slight change in strategy provides almost twice as much return. Instead of $6,000, an investor has a little more than $13,500 at the end of 80 years.

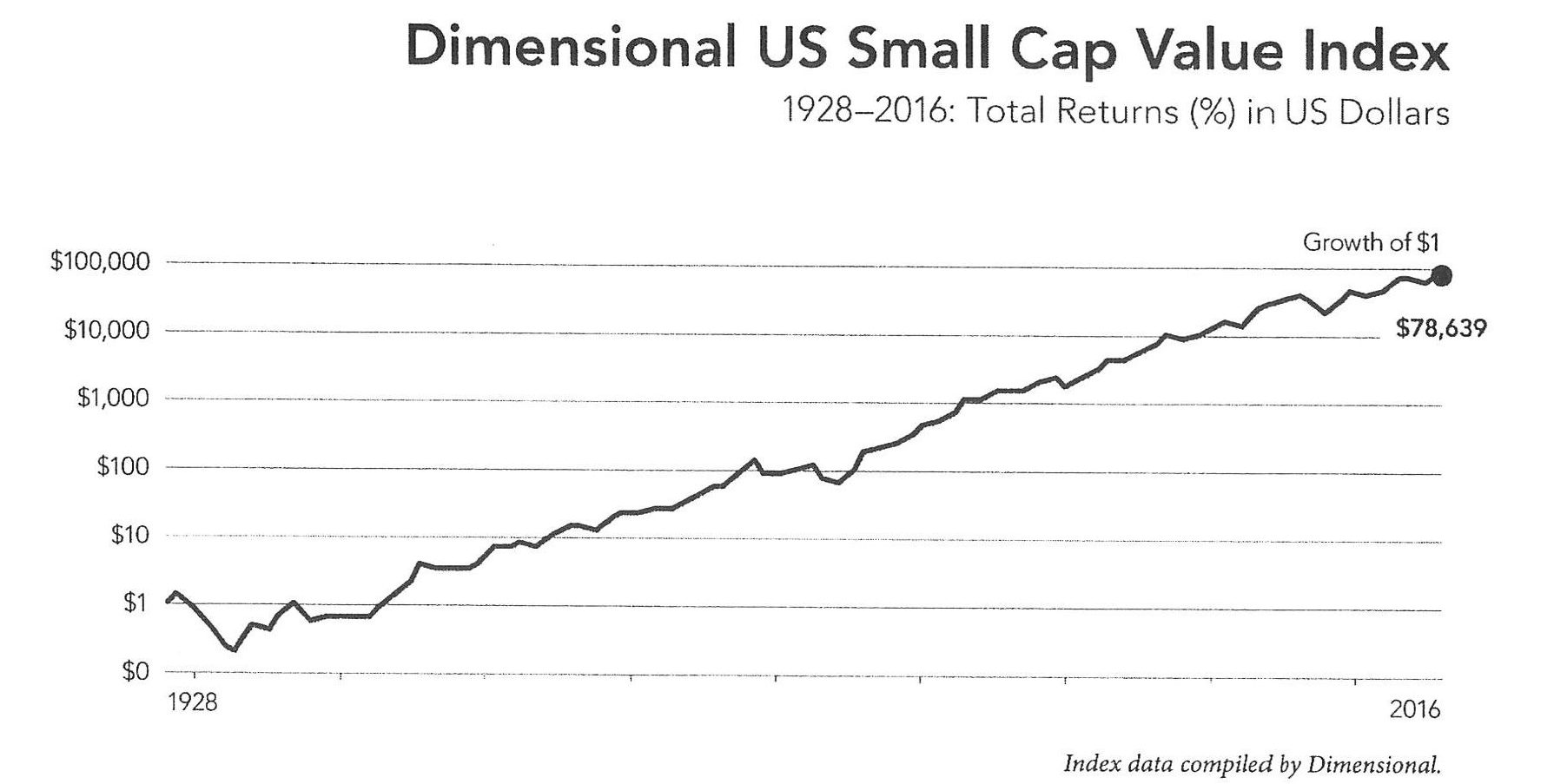

But here is the real stunner. By combining small-capitalization stocks with the value factor, the results are truly out-of-this-world.

Take a moment to consider the difference between US Long-term bonds and this strategy. After 80 years, an investor “playing it safe” with fixed-income would have at most $200 for every $1 invested. By focusing on small-cap value, this same investor would have over $78,500.

Value Investing

It's no wonder that some of the most celebrated investors throughout the ages have focused on the value strategy. Whether it is Warren Buffett, Peter Lynch, or Julian Robertson, they have all understood the tremendous edge that investing with this discipline offers.

But what is “value investing”?

Typically, it involves buying stocks with lower than average price to book ratios or lower than average price-earnings ratios. Of course, it's not quite this simple, and there are many different flavors to the strategy, but at its heart value investing involves buying stocks that are cheap based on quantitative factors.

Yet isn't that what all investors try to do? Aren't we all trying to buy stocks that are cheap?

One might think this behavior fairly self-evident, but in practice, it is much more difficult to implement. For example, in the current environment, which stocks are investors flocking to? Stocks that have a story. Stocks that are sexy. Stocks that are going up. Names like Amazon and facebook. What stocks are investors avoiding? Stocks with challenging fundamentals like old-school conglomerates or those with disappointing themes that have made whole sectors cheap – like energy.