Daily Forex Market Preview, 2/17/2016

The markets seem to be moving sideways following the previous weeks of strong price action. The FOMC meeting minutes are due for release later this evening and could potentially keep the US Dollar at risk with most of the USD Crosses looking to regain some of the declines since last Friday.

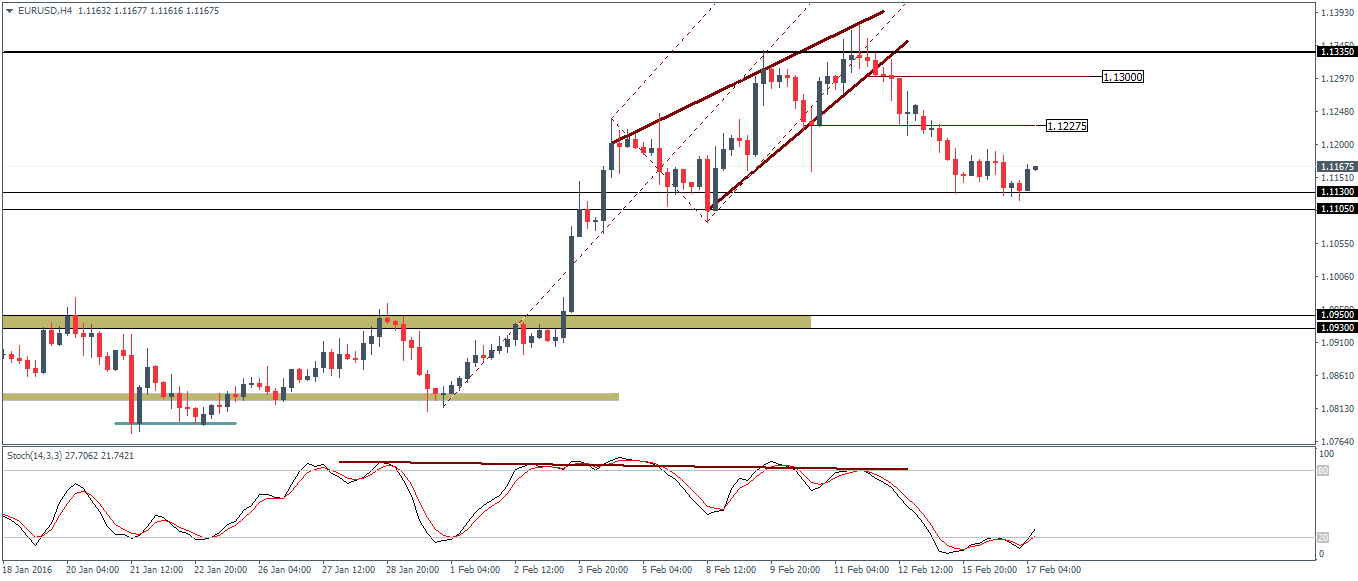

EURUSD Daily Analysis

EURUSD (1.11): EURUSD closed at a 5-day low yesterday but the declines are showing signs of exhaustion. Price action is currently bullish and a close above yesterday's high of 1.1193 could signal a modest correction to the upside. With prices capped below 1.13, the bias remains to the downside. A modest pullback to the declines could see prices retest 1.12275 or as far as up to 1.13 region, marking a retest of the rising wedge breakout. With support being established at 1.113, the pullback to the upside should see EURUSD prepare for a new leg of declines, following a break below 1.113 – 1.11, to test the next lower support at 1.095 – 1.093.

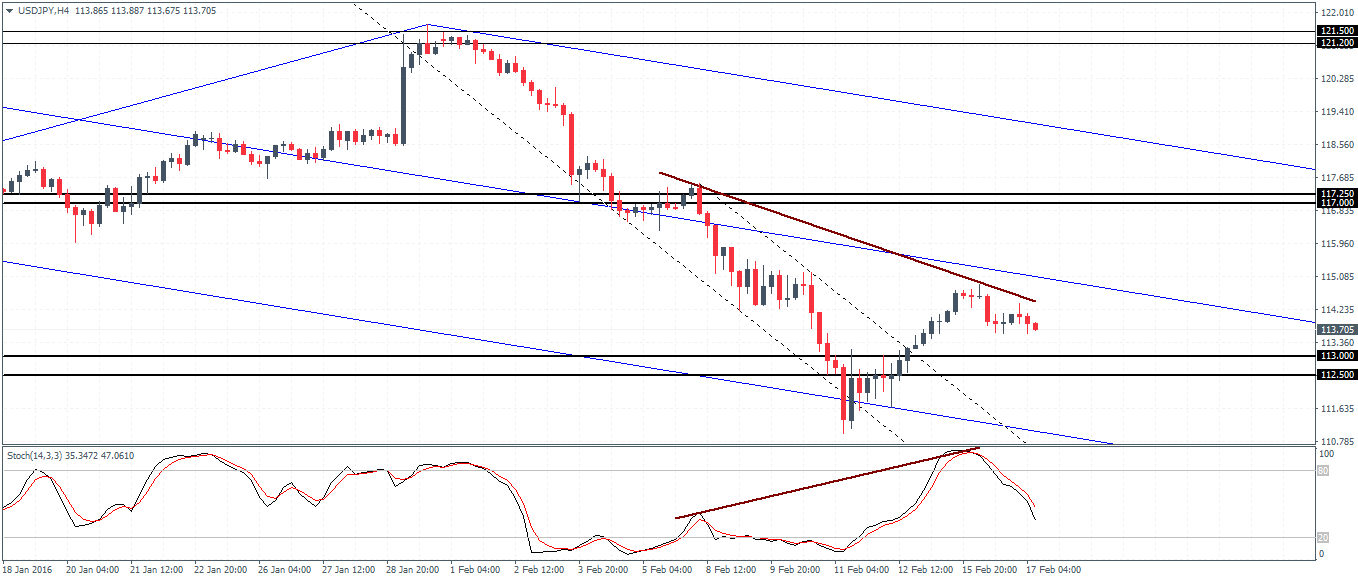

USDJPY Daily Analysis

USDJPY (113.6): After two days of bullish gains, USDJPY is retreating lower again, but prices are likely limited to the downside. Support at 113 – 112.5 is most likely to be tested to the downside, followed by a correction to 116.21. The hidden bearish divergence on the H4 chart confirms the decline to the downside to test for support, with a longer-term target of 117.25 – 117 following a break above 116.21. In the event USDJPY declines below the 112.5 support, the further downside cannot be ruled out.

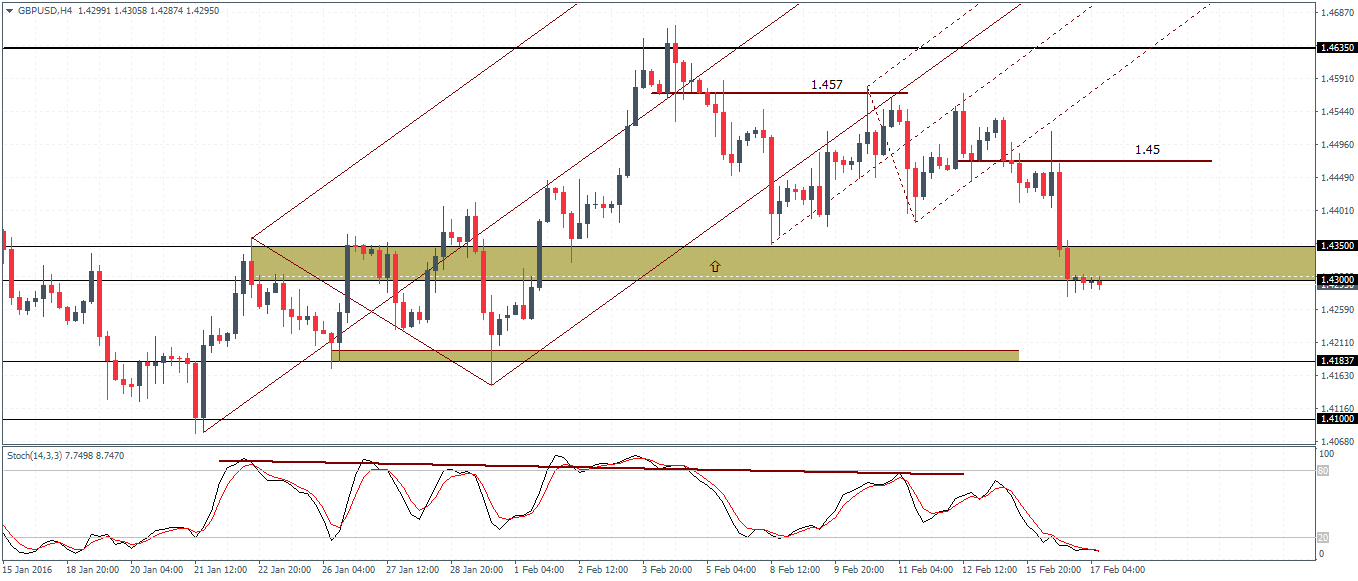

GBPUSD Daily Analysis

GBPUSD (1.42): GBPUSD broke below the 1.443 handle yesterday and is currently trading below 1.43. Next support to the downside comes in at 1.42. With the previous support level being broken, GBPUSD could be looking to dip lower. However, in the event that price action manages to break above 1.435, GBPUSD could be resuming a new leg to the upside, with 1.45 coming into immediate focus. Above 1.45, a test to previous highs at 1.4635 is very likely.