There's no shortage of macro risks facing the US economy, but personal income and spending aren't among them, at least not in today's update. Both measures increased at healthy if unspectacular rates in November vs. the previous month, the Bureau of Economic Analysis reports.

The upbeat data delivers an optimistic round of figures after a string of disappointing releases from other corners of the economy—manufacturing in particular. As a result, the economic outlook looks a bit brighter. Thanks to the outsized influence of consumer spending in the US economy, today's news implies that the macro trend overall will remain positive.

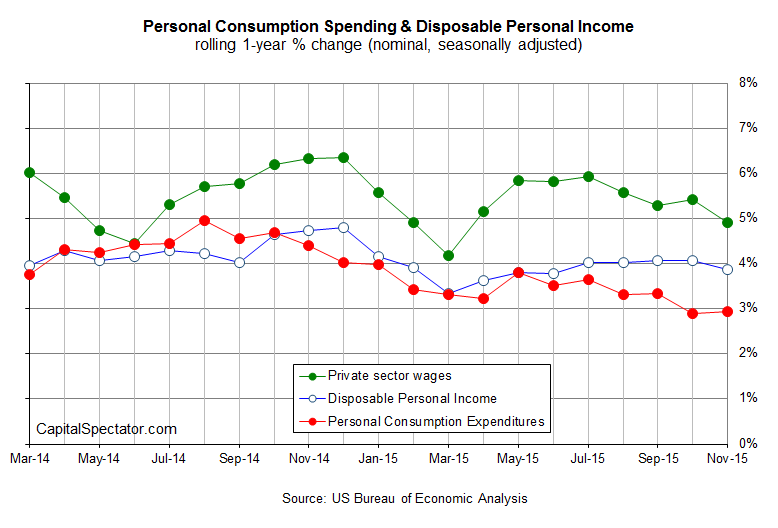

The year-over-year growth rates through last month continue to post middling results relative to recent history, but the income and spending trends still align with expectations for an expanding economy. Disposable personal income ticked lower, rising 3.9% for the year through November—the slowest since June. Meanwhile, consumer spending held steady at an annual increase of 2.9%. Nonetheless, the fact that income continues to rise at a faster pace than spending in year-over-year terms suggests that consumption's growth rate will remain steady and perhaps tick higher in the new year.

Recall that the numbers in last month's update looked a bit troubling in terms of spending. Today's release, however, allays those worries to a degree and the news offers fresh support for last week's monetary tightening.

“I feel confident about the fundamentals driving the US economy, the health of US households, and domestic spending,” Fed Chair Janet Yellen said last week in connection with the central bank's first increase in interest rates in nine years. “There are pressures on some sectors of the economy, particularly manufacturing, and the energy sector… but the underlying health of the US economy I consider to be quite sound.”