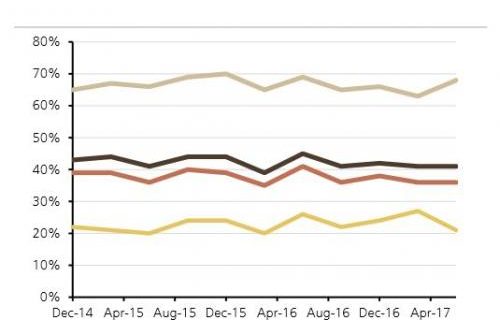

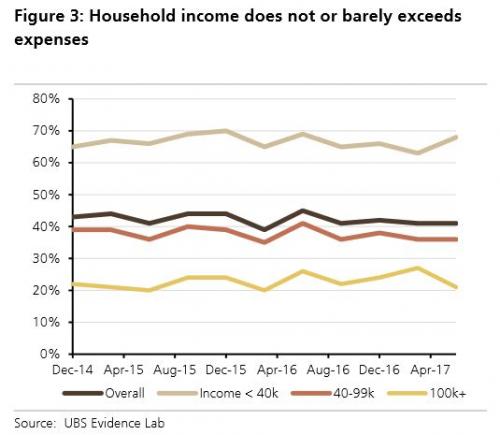

In their 2Q 2017 survey, UBS found that, for the first time since at least 2014, the trajectory of financial health of low-income households has started to diverge from that of more affluent households. Per the graph below from UBS' credit strategy team led by Matthew Mish, while a firming job market has helped households making over $100,000 feel more confident about covering their monthly expenses, spiraling debt balances has left low-income families even more vulnerable to the slightest monthly surprises with 70% reporting that their income just barely covers monthly expenses.

Overall US consumers report a lower likelihood of defaulting on a loan payment in the next year (15% vs. 17% in Q1), but lower income households cited an increase in their default probability (13% vs 9% in Q1). Other responses suggest consumers are incrementally more confident in their ability to pay given labor market stability, but optimism on the outlook is moderating. However, replies from lower income households paint a pessimistic outlook, partly due to lackluster real wage growth, higher financing rates and highly regressive policy.

Of course, with the entire auto and student loan bubbles being fueled by a massive expansion in subprime credit to the most at-risk American households, it's not terribly surprising that the lowest-income folks (i.e. those least prepared to absorb things like rate increases) are suddenly starting to feel the pain of their reckless balance sheet expansions.

There is a fairly strong relationship between income and credit scores, which implies the implications of this divergence will be primarily felt in non-prime and subprime consumer credit markets. Based on credit scores alone (VantageScores below 600), the three largest consumer loan markets in terms of subprime debt outstanding are the US mortgage ($570bn), student ($370bn) and auto loan markets ($180bn, Figure 4). We use the term ‘subprime' lightly as some regulators characterize subprime credit scores as those below 660 (vs. 600) and risk-layering in consumer loans (e.g., autos) has been prevalent (which increases the riskiness of loans), both of which would in theory increase the subprime debt balances shown.

We believe the auto loan market best illustrates the fulcrum of credit quality trends in the US subprime consumer sector – one key ‘canary' in the coalmine for US consumer credit. Rising collateral values and easy lending conditions supported by federal agency financing do not make the residential mortgage market a leading indicator this cycle, although US subprime mortgage delinquencies proxied by FHA delinquency rates will be important to watch. And US student loan delinquencies are heavily manipulated by the fact that many loans are not yet in payment status and deferral/ modification programs.