The risk of a correction in the equity bull market

Since March 2009, the US stock market has been trending broadly higher. If we can continue to make new highs, or at least, not correct to the downside by more than 20%, until August of this year it will be the longest equity bull-market in US history.

The optimists continue to extrapolate from the unexpected strength of 2017 and predict another year of asset increases, but by many metrics the market is expensive and the risks of a significant correction are become more pronounced.

Equity volatility has been consistently low for the longest period in 60 years. Technical traders are, of course, long the market, but, due to the low level of the VIX, their stop-loss orders are unusually close the current market price. A small correction may trigger a violent flight to the safety of cash.

Meanwhile in Japan, after more than two decades of under-performance, the stock market has begun to play catch-up with its developed nation counterparts. Japanese stock valuation is not cheap, however, as the table below, which is sorted by the CAPE ratio, reveals:-

Source: Star Capital

Global economic growth surprised on the upside last year. For the first time since the great financial crisis, it appears that the Central Bankers experiment in balance sheet expansion has spilt over into the real-economy.

An alternative explanation is provided in this article – Is Stimulus Responsible for the Recent Improved Trends in the u.s. and Japan? – by Dent Research – here are some selected highlights:-

Since central banks began their B.S. back in 2001, when the Bank of Japan first began Quantitative Easing efforts, I've warned that it wouldn't be enough… that none of them would be able to commit to the vast sums of money they'd ultimately need to prevent the Economic Winter Season – and its accompanying deflation – from rolling over us.

Demographics and numerous other cycles, in my studied opinion, would ultimately overwhelm central bank efforts…

Are such high levels of artificial stimulus more important than demographic trends in spending, workforce growth, and productivity, which clearly dominated in the real economy before QE? Is global stimulus finally taking hold and are we on the verge of 3% to 4% growth again?…Fundamentals should still mean something in our economy…

And my Generational Spending Wave (immigration-adjusted births on a 46-year lag), which predicted the unprecedented boom from 1983 to 2007, as well as Japan's longer-term crash of the 1990s forward, does point to improving trends in 2016 and 2017 assuming the peak spending has edged to 47 up for the Gen-Xers.

The declining births of the Gen-X generation (1962 – 1975) caused the slowdown in growth from 2008 forward after the Baby Boom peaked in late 2007, right on cue. But there was a brief, sharp surge in Gen-X births in 1969 and 1970. Forty-seven years later, there was a bump… right in 2016/17…

Source: Dent Research

The next wave down bottoms between 2020 and 2022 and doesn't turn up strongly until 2025. The worst year of demographic decline should be 2019.

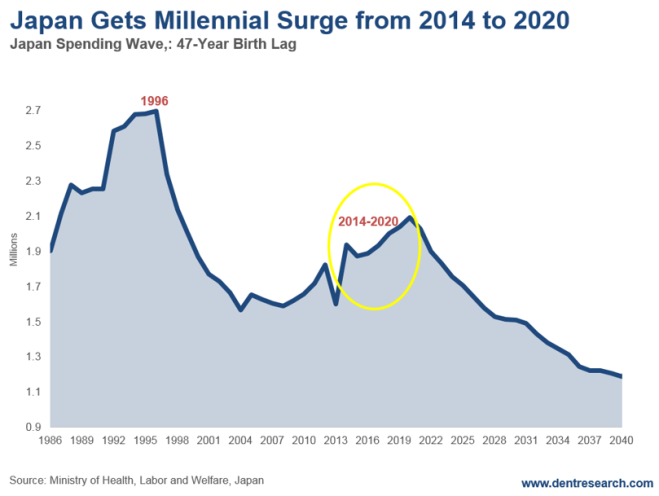

Japan has had a similar, albeit larger, surge in demographics against a longer-term downtrend.

Its Millennial generation brought an end to its demographic decline in spending in 2003. But the trends didn't turn up more strongly until 2014, and now that they have, it'll only last through 2020 before turning down dramatically again for decades…

Source: Dent Research

Prime Minister Abe is being credited with turning around Japan with his extreme acceleration in QE and his “three arrows” back in 2013. All that certainly would have an impact, but I don't believe that's what is most responsible for the improving trends. Rather, demographics is the key here as well, and this blip Japan is enjoying won't last for more than three years!..

If demographics does still matter more, we should start to feel the power of demographics in the U.S. as we move into 2018.

If our economy starts to weaken for no obvious reason, and despite the new tax reform free lunch, then we will know that demographics still matter…

A different view of the risks facing equity investors in 2018 is provided by Louis-Vincent Gave of Gavekal, care of Mauldin Economics – Questions for the Coming Year – he begins with Bitcoin:–