Never in the history of US equity markets has the S&P 500 closed above its 5-day moving average for 28 days in a row… until today. While most indices tracked sideways in a very narrow range today, Trannies outperformed (helped by weaker oil, but even when oil rallied intraday Trannies rallied too). VIX tracked back below 12.5 with an inverted term structure for the 5th day in a row. The USD lost ground for the 2nd day in a row, driven by EUR strength (with notable AUD weakness extending). Silver rallied as gold flatlined and copper tumbled after US GDP beat. However, the two big themes today were the collapse in oil prices (as rumors/news ahead of OPEC sent volatility soaring) to a $73 handle – the lowest close since 2010; and the plunge in Treasury yields (with a very stroing 5Y auction and big block trade in TLT suggesting short-covering). Finally, AAPL broke above a $700 billion market cap briefly today but was unable to hold it.

28 days and counting… will the S&P ever be allowed to break its 5DMA

On the day, Trannies led the way… though they finally started to get the joke of what collapsing oil prices means into the close… Russell 2000 was rescued at the very last minuet to close barely green, S&P red…

We thought this was interesting, YTD performance of some of the crazier momo names…

USDJPY and stocks lost some correlation late on…

The disconnect between stocks and bonds is becoming irrationally…

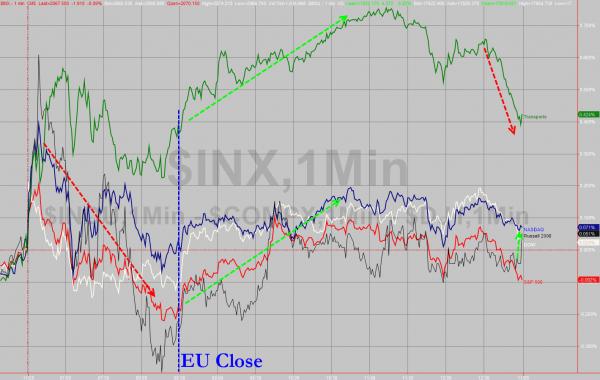

and HY energy credit names were hit hard today as stocks decoupled from credit after Europe closed…

FX markets were dominated by a 2nd day of USD weakness/EUR strength but AUD weakness is also notable…

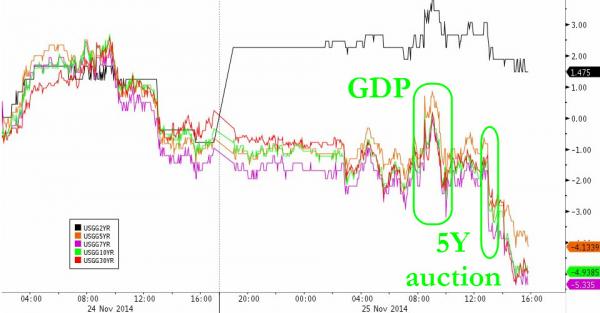

But bonds were notably strong today with 30Y back under 3.00% and 7Y back under 2% – back at one-month lows… (2Y move is a roll so just look at today's action)

With a notable block trade popping up on TLT suggesting someone was forced to cover shorts… (note there was a big block sell in TBT at the same time)