Stanphyl Capital June 2018 letter to investors on Tesla Inc. (NASDAQ:TSLA)

The fund was absolutely massacred this month, and it was primarily due to our large short position in Tesla, to which I added on each new piece of negative news, much of which was indicative of the kind of outright fraud (see below) that would immediately send a “normal stock” into a death spiral, and yet for most of the month Tesla's stock kept levitating. So here's what I've done about it: I slashed our common stock short position to approximately 15% of the fund from a much larger size and then put approximately 12% of the fund into far less volatile January 2020 put options (as nearly all the luxury EV competitors will be in showrooms by 2019) with a strike price of $210. Then in light of recent whistleblower stories (see below for more detail) and the potential for a fast Tesla death spiral as it may be under a Wells Notice (also see below), I put another 0.30% (30 basis points) of the fund into an array of near-term (out one to three months) put options that will pay off hugely if a TSLA stock crash is imminent.

As noted above, we remain short shares of (and long put options in) Tesla, Inc. (TSLA), which I consider to be the biggest single stock bubble in this whole bubble market—a company so landmine-filled that I think it can implode at any moment regardless of what the broad market does. To reiterate the three core points of our Tesla short position:

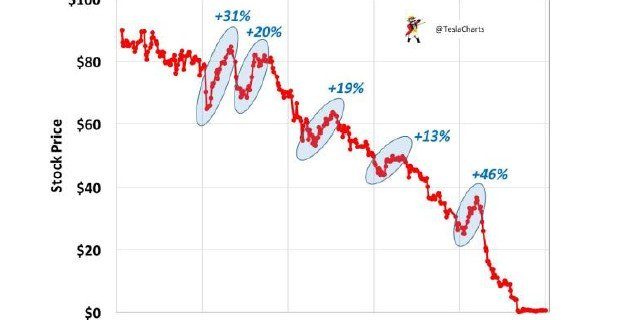

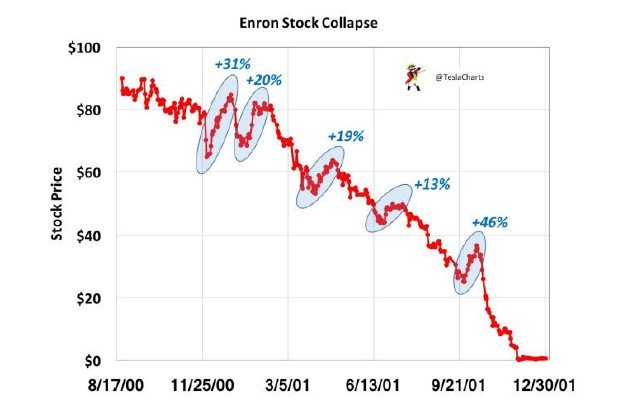

Despite its recent rally TSLA remains 12% off its all-time high and once again appears to be downtrending, and it's worth noting that although this has been a rough road for us, it's not a unique one:

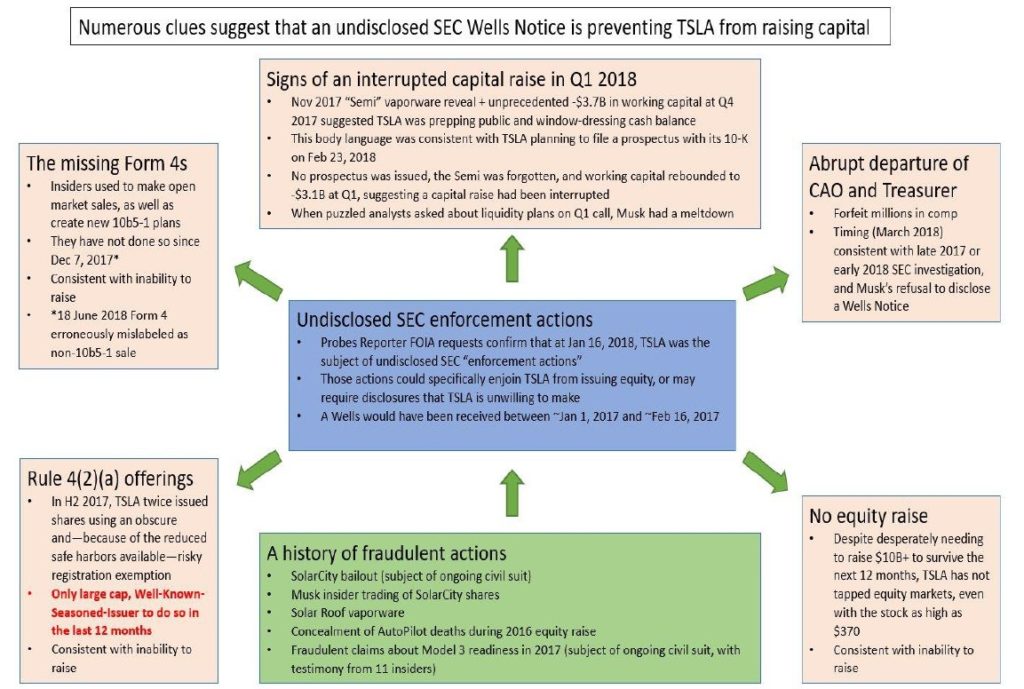

I wrote earlier that Tesla may be under an undisclosed Wells Notice, and if that's the case (and this is completely speculative) it may explain why the company hasn't been able to take advantage of its $300+ stock price to raise fresh equity. Courtesy of Twitter user @ElonBachman, here's a terrific representation as to why this is a plausible (but admittedly unproven) theory:

Also “headlining” this month in Tesla news is an astonishing new report from Twitter user @eriz35 (an environmental engineer) pointing out that Tesla's paint facility only has physical capacity for a total of approximately 5000 cars a week including, presumably, 2000 Models S/X, meaning (if the report is accurate) that Tesla and Elon Musk have been committing blatant securities fraud in claiming to have capacity to build 5-6000 Model 3s a week plus 2000 Models S and X. However, as this story just broke today (June 30th), it's important to emphasize that we don't yet have a definitive answer as to its accuracy.

Speaking of paint, early in June came an astounding story about Tesla failing to report multiple fires in its paint shop while simultaneously conducting hugely unsafe practices there (for both employees and customers), followed by another astounding story about the vast amount of scrappage occurring in its manufacturing process accompanied by hugely unsafe practices in how those manufactured parts are labeled and tracked, followed by another astounding story full of well-documented instances of Tesla safety and securities fraud violations. Later in the month Tesla sued the employee whistleblowing source of some of that information, undoubtedly hoping to squelch others in the future. But based on the massive number of recent executive departures (including, in June, the CIO), I strongly suspect that many more whistleblowers will soon appear.

Also in early June came a series of fabulous reviews of the new Jaguar I-Pace electric SUV, which is in European showrooms now and will be available in the U.S. in August. As a reminder, the I-Pace starts at a price $10,000 lower than the Tesla Model X, and that gap will eventually widen to $17,500 as Tesla's tax credits gradually phase-out beginning late this year or early 2019. Next on tap in luxury EVs are the Audi Audi(to be formally unveiled in September and available in Europe this winter and the U.S. next spring) and the Mercedes EQC (also to be unveiled in September and available next spring), followed by the Porsche Taycan (previously called the Mission E, and available some time in 2019). And all those cars (except the Porsche) will be priced significantly less expensively than the comparable Tesla even before their U.S. buyers enjoy the $7500 tax credit that will soon expire for Tesla. (The Porsche's base price will be similar to that of the base Tesla Model S and come with the tax credit. Hmmm, Tesla or Porsche… tough choice!)