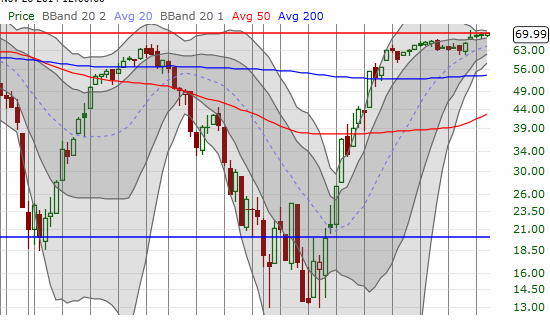

T2108 Status: 69.99%

T2107 Status: 54.6%

VIX Status: 12.1

General (Short-term) Trading Call: Hold (bullish positions)

Active T2108 periods: Day #28 over 20%, Day #26 over 30%, Day #23 over 40%, Day #21 over 50%, Day #16 over 60% (overperiod), Day #98 under 70% (underperiod)

Reference Charts (click for view of last 6 months from Stockcharts.com):

S&P 500 or SPY

SDS (ProShares UltraShort S&P500)

U.S. Dollar Index (volatility index)

EEM (iShares MSCI Emerging Markets)

VIX (volatility index)

VXX (iPath S&P 500 VIX Short-Term Futures ETN)

EWG (iShares MSCI Germany Index Fund)

CAT (Caterpillar).

Commentary

So tantalizing part 2.

Hard to believe, but, yes, T2108 closed at 69.99% today.

T2108 continues to tease along the overbought threshold

This is a rounding away from 70% and so essentially represents overbought, especially after T2108 first crossed the 70% threshold 3 days ago and scraped along it since. Because my code that calculates historical relationships defines overbought strictly as 70.0% and above, I am not starting the counter just yet. For trading purposes, this milestone of 69.99% is definitely good enough to trade as if T2108 is overbought. Refer to the last T2108 Update for related trading rules.

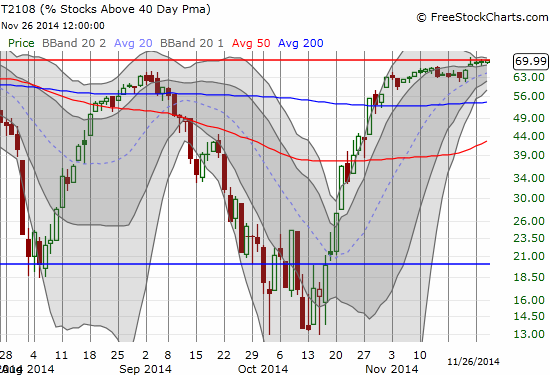

The S&P 500 closed strong at its high of the day and a new closing all-time high. It did not beat out the intraday high though.

Looks like yet more room to run for the S&P 500

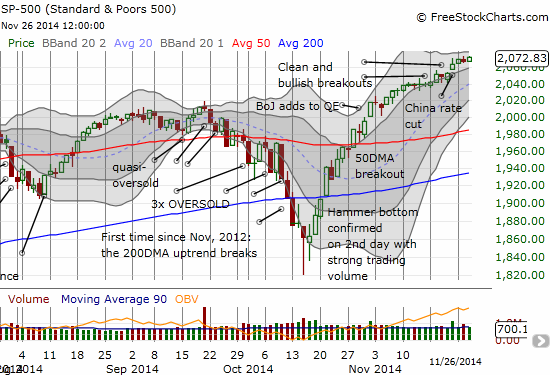

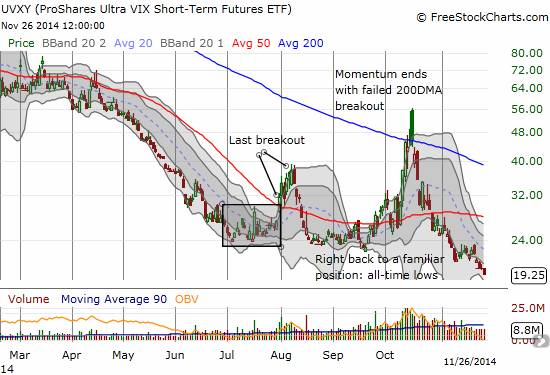

The VIX is continuing its downtrend as it hit 12.1%. Since a major fade from the 15.35 pivot last week, the VIX has been going down in a straight line by steady and nearly equal increments. There is still a short runway to go lower still. I have not shown the destructive impact on ProShares Ultra VIX Short-Term Futures (UVXY) in a while. Too bad I have not focused on put options on UVXY over the past week.

UVXY still knows no bottom

Or maybe I should have just stayed long ProShares Short VIX Short-Term Futures (SVXY):