Presently, the state of US trade deficit and how the Trump administration is attempting to address it is front and center.

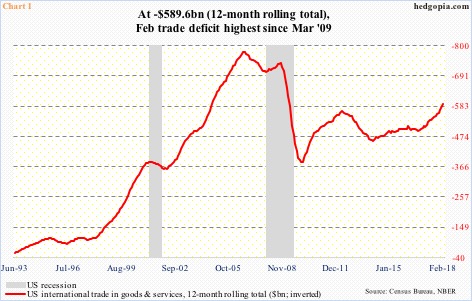

In February, the deficit came in at $57.6 billion, with the 12-month total of $589.6 billion, which was the highest since March 2009 (Chart 1). China – a manufacturing hub – is a big part of this. The Administration is trying to remedy the situation through imposition of tariffs.

On March 1, Trump promised 25-percent tariffs on steel imports and 10-percent on aluminum imports.US stocks fell in that session (Thursday) and again early in the next session before buyers showed up.Late Tuesday last week, the president announced 25-percent tariffs on $50 billion worth of Chinese imports.Wednesday, stocks opened down but that weakness was bought.Less than 12 hours after the tariff announcement, China issued a list of US products worth $50 billion for possible tariff hikes.Then on Thursday, Trump proposed $100 billion in additional tariffs against China.Markets did not take this nicely.Major US equity indices fell north of two percent on Friday.If the US releases a list of $100 billion worth of tariffs, China in all likelihood will follow suit.

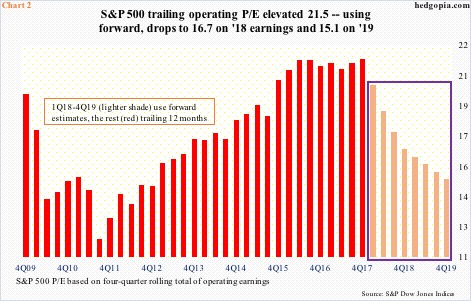

Where is this headed? Is what looks like a skirmish right now on its way to evolving into a war? More importantly, were stocks looking for a reason to sell off anyway and the trade dispute just became an excuse?

The bull market in US stocks is in its 10th