There is an obvious relationship between supply and demand. In the rental housing market, demand is eroding supply at a rapid rate according to recent data – likely due to changing demographics and preferences. The Consumer Price Index (CPI) is based 40% on housing costs – so the logical conclusion is that a rapid rise in inflation is just around the corner.

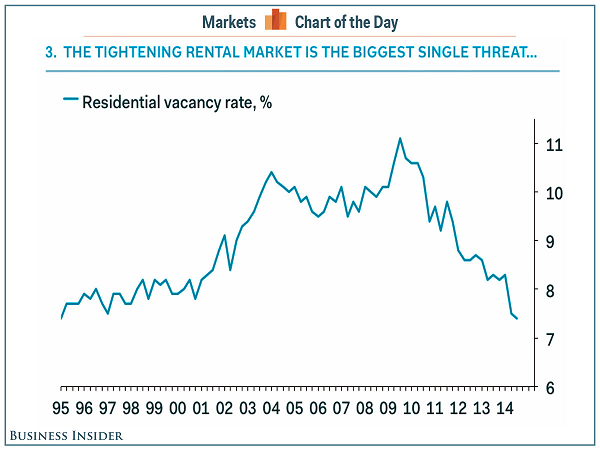

The trigger for this post was a Business Insider graphic Here's The Single Biggest Threat To Inflation which stated in part:

Renting is all the rage these days, and the tightening of the residential rental market is the biggest threat to inflation, according to Ian Shepherdson, the chief economist at Pantheon Macroeconomics. The logic is simple. When there are few places to rent, landlords will jack up prices.

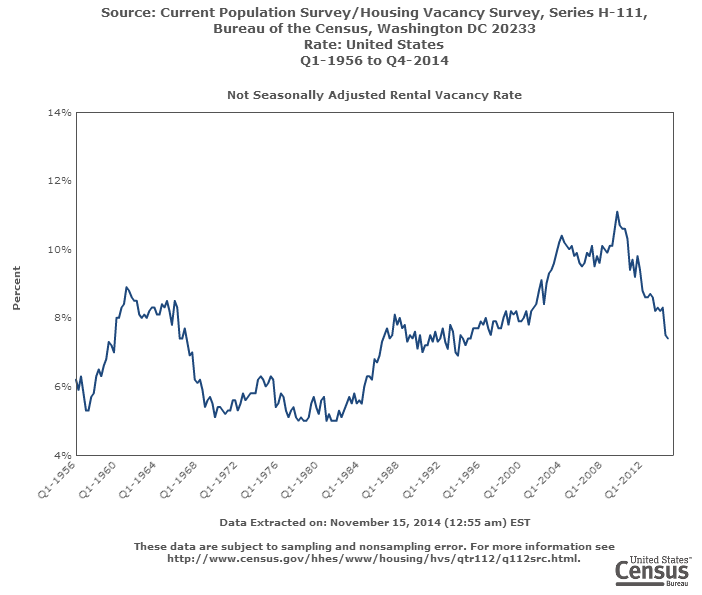

The graph below from US Census is an expanded version of the Business Insider graph but with data back to 1956.

Please compare the CPI (housing portion) with the graph above. The rental housing market was tight between 1968 and 1984 – and that corresponds almost exactly with the highs in the housing portion of the CPI. Based on the current trends on the rental housing vacancy rates – it will take 2 or 4 more years to get the rental vacancy rate under 6% (where rental inflation took hold between 1968 and 1984).

Note that the housing component of the CPI is rent of primary residence, owners' equivalent rent, fuel oil, bedroom furniture). The CPI is based on RENT and not costs for buying a home. Increases in rental prices will absolutely put upward pressure on inflation (because of the way inflation is measured). [Hat tip to Doug Short for graph below].

One fly in this argument is that in 1968 to 1984, the USA did not have 13 million vacant residences. There is a shadow inventory of vacant potential rental units. Admittedly, many are in disrepair or in the wrong city or the wrong part of town. It is hard to believe this “shadow” potential supply of rental units will not have an affect on this timeline.