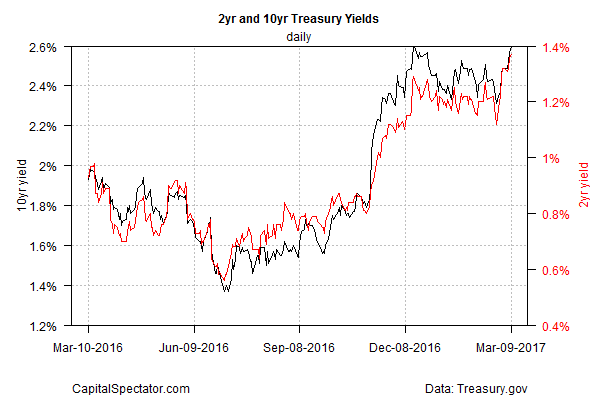

The 10-year Treasury yield ticked up to 2.60% on Thursday… again. The benchmark rate reached that level in December (the highest since 2014) following the reflationary wave that followed Donald Trump's election victory. But yields pulled back in 2017… until yesterday.

The 2.60% mark for the 10-year Note has been a talking point for investors in the weeks after bond manager Bill Gross marked it as a critical threshold.

“If 2.60% is broken on the upside… a secular bear bond market has begun,” he wrote on January 10. “Watch the 2.6% level. Much more important than Dow 20,000. Much more important than $60-a-barrel oil. Much more important that the Dollar/Euro parity at 1.00. It is the key to interest rate levels and perhaps stock price levels in 2017.”

Since then, the 10-year yield has traded in a range of roughly 2.30% to just above 2.50% through last week, based on daily data via Treasury.gov. But in recent days, expectations for a rate hike at next week's FOMC meeting have gathered momentum, in part because of the dramatic rise in private-sector payrolls in February, according to the ADP Employment Report. The probability that the federal reserve will lift its target rate on Mar. 15 is nearly 90%, according to Fed funds futures (as of Mar. 9).

Today's key economic release (at 8:30 am Eastern) – the Labor Dept.'s estimate of payrolls in February – will factor into the outlook for next week's monetary policy meeting. Economists are looking for a healthy gain of 200,000 jobs in the private sector, albeit down from the 237,000 increase in January, according to Econoday.com's consensus forecast. But as I discussed yesterday, there's a good case for expecting an upside surprise today, courtesy of the strong gain in February via ADP's estimate. In that case, the prospects for a rate hike will look even more secure and the 10-year yield could move decisively above the 2.60% mark.