Third China devaluation, EURUSD in dilemma

A third China devaluation took place today but this time it came to no one's surprise. On Tuesday the CNY was devalued by 1.9%, on Wednesday a further -1.6% and today -1.1%. This sent shockwaves across stock markets as now Chinese will find it more expensive to import goods. As an example BMW shares dropped 8% since this has started as luxury cars will find less buyers in vhina. This explains the huge drop in DAX of over -6% in the last 2 days since Germany is the largest exporter to China. AUS shares as well as its currency have suffered as the country down under is one of China's biggest trade partners.

The picture is different in regards to EURUSD and other majors versus the USD, since this move from China is now lowering chances for the FED to start hiking rates in September. Goldman Sachs now believes that a rate hike would happen in December, if any. EUR rose to 1.1213 (5 week high), despite bad economic data out of the region. 1.1120 now serves as a support and as long as the price remains above this level, further upside towards 1.1240 cannot be ruled out.

Today we have the CPI numbers in EZ, ECB Minutes from last meeting and the very important US retail Sales at 12:30 GMT.

Trading quote of the day:

“It's not whether you are right or wrong that's important, but how much money you make when you are right, and how much money you lose when you're wrong”

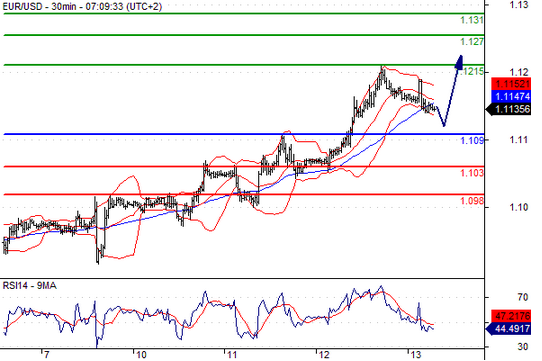

Green lines are resistance, Red lines are support

EURUSD

Pivot: 1.109

Likely Scenario: Long positions above 1.109 with targets @ 1.1215 & 1.127 in extension.

Alternative scenario: Below 1.109 look for further downside with 1.103 & 1.098 as targets.

Comment: Even though a continuation of the consolidation cannot be ruled out, its extent should be limited.

GBPUSD

Pivot: 1.554

Likely Scenario: Long positions above 1.554 with targets @ 1.5675 & 1.571 in extension.

Alternative scenario: Below 1.554 look for further downside with 1.551 & 1.548 as targets.

Comment: Technically the RSI is above its neutrality area at 50.