Written by Gail Tverberg, Our Finite World

The world economy is shrinking. The evidence is all around us. All we have to do is be rational to understand. Yet the world is in denial.

Last week, I gave a fairly wide-ranging presentation at the 2016 Biophysical Economics Conference called Complexity: The Connection Between Fossil Fuel EROI, Human Energy EROI, and debt (pdf). In this post, I discuss the portion of the talk that explains several key issues:

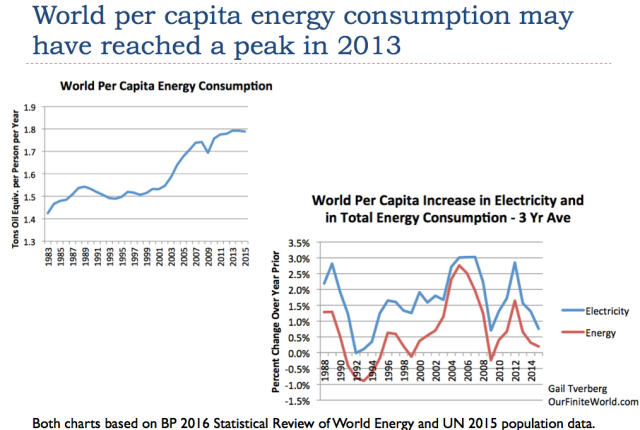

Why we are right now seeing so many problems with respect to wealth disparity and low commodity prices (Answer: World per capita energy consumption is already falling, and the energy/economy system needs to reflect this problem somehow.)

Why the quest for growing technology leads to growing wealth disparity (Answer: The economy must be configured in more of a hierarchical pattern to support growing “complexity.” Growing complexity is the precursor to growing technology.)

Why rising debt is an integral part of the energy/economy system (Answer: We could not pay workers for making long-lasting goods and services without using debt to “pull forward” the hoped-for benefit of these goods and services to the present, using debt and other equivalent approaches.)

Why commodity prices can suddenly fall below the cost of production for a wide range of products (Answer: Prices of commodities depend to a significant extent on debt levels. A major problem is that when commodity prices rise, wages do not rise in a corresponding manner. Rising debt levels can mask the growing lack of affordability for a while, but eventually, debt levels cannot be raised sufficiently, and commodity prices fall too low.)

The Brexit vote may be related to falling energy per capita in the UK. Given that this problem occurs in many countries, it may be increasingly difficult to keep the Eurozone and other similar international organizations together.

My talk also touches on the topic of why a steady state economy is not possible, unless we can live like chimpanzees

My analysis has as its premise that the economy behaves like other physical systems. It needs energy – and, in fact, growing energy – to operate. If the system does not get the energy it needs, it “rebalances” in a way that may not be to our liking. See my article, “The Physics of Energy and the Economy.”

An outline of my talk is shown as Slide 2, below. I will omit the EROI and Hubbert model portions of Complexity: The Connection Between Fossil Fuel EROI, Human Energy EROI, and Debt.

Peak World Coal Seems To Be Happening, Right Now

In the view of most of the researchers I was talking to at this conference, oil is likely to be the first problem, not coal. And the issue is likely to be high prices, not low. So peak coal now, as shown in Slide 3, doesn't seem to make sense. Yet, my analysis of recent data strongly suggests that peak coal is exactly what is happening, right now.

I will show later in this presentation why peaking coal production does seem to make sense – price levels of all fossil fuels seem to vary together. The extent to which debt levels are growing seems to be a major factor in price levels. When the debt level is not growing rapidly enough, “demand” is not high enough, and prices for all fossil fuels tend to fall simultaneously. A related issue is the extent to which the world economy is growing; if world economic growth is too slow, this will also tend to hold down demand, and thus energy prices.

China's rate of growth in coal production started falling back in 2012, which is when coal prices started falling. This is before China's new leadership took over in March 2013. We know that coal production in China is likely to continue falling, because China's energy bureau is reporting that China plans to close over 1000 coal mines in 2016, because of a “price-sapping supply glut.” See my article, “China: Is peak coal part of its problem?” for additional information.

World Per Capita Energy Consumption Seems To Have Already Started Falling

The reason why I say that world per capita energy consumption may have reached a peak in 2013 is partly because coal consumption appears to have peaked. If coal has peaked, it will be hard to make up the shortfall using other fuels, such as renewables, or even natural gas. Furthermore, recent world figures (shown above) already show a small drop in per capita energy consumption. If world coal production continues to drop, we can expect world per capita energy consumption to continue to drop.