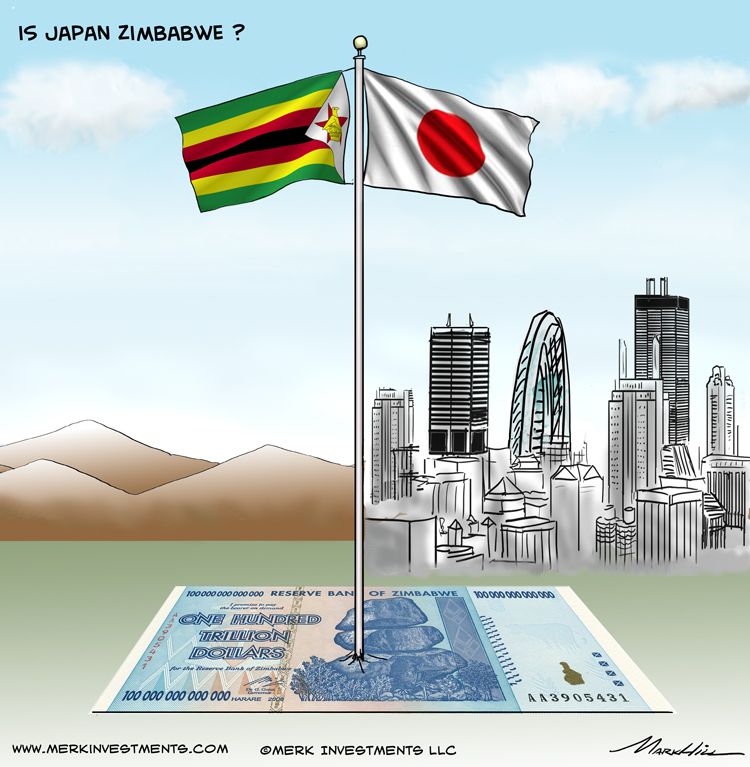

Is Japan Zimbabwe? How preposterous: Japan is an advanced economy that cannot possibly suffer the same fate as Zimbabwe. Right? Or could Japan get hyperinflation? Below I explain why Japan, and with it investors' portfolios, might be at risk.

The other day, when I was on a panel discussing unsustainable deficits in the u.s., Eurozone and Japan, the risk of inflation and Zimbabwe style hyperinflation came up. When asked about the difference about Japan and Zimbabwe, I quipped that there isn't any. My co-panelists were all over me, arguing Japan is different. Notably that Japan could not possibly go broke because, unlike Zimbabwe, it's an advanced economy. The argument being that Japan produces goods the world wants.

To be clear: Zimbabwe and Japan are not the same. But are they really that different? Zimbabwe not only had a much weaker economy, but also much weaker institutions. But the old adage that something unsustainable won't last forever may still hold.

The difference between Zimbabwe and Japan – and Europe and the U.S. for that matter – is that advanced economies have more control over their destiny. However, all these regions have made commitments they cannot keep by continuing business as usual. A weak country may simply implode. A strong country has choices. The preferred choice these days appears to be to kick the proverbial can down the road.

Currently, to get the country out of its malaise, Japan is trying the three arrows of Abenomics, a combination of government spending, monetary easing and structural reform. Except, of course, when the first two arrows are deployed, there's little incentive left for the third. Structural reform is a codename for the tough choices that need to be made to get an economy to be more competitive, including flexible labor markets and less regulation.

Because the Bank of Japan gobbles up dramatic amounts of debt, the cost of financing government spending stays low. It's been said that a country that issues debt in its own currency cannot go broke. Theoretically that may be correct: the central bank can always monetize the debt, i.e. buy up any new debt being issued. But in practice, there has to be a valve. In my assessment, that valve is the currency. Hence my prediction is that the yen will reach “infinity” versus the dollar (a ‘higher' yen represents a weaker currency), i.e. be worthless at some point.