That sinking feeling really came from the financials. Several big banks reported earnings. JP Morgan (JPM) and Citigroup (C) came out the gate strong with gaps up. While Citigroup rammed right into resistance at its downtrending 50DMA, JPM seemed to confirm the previous day's 50DMA breakout. Sellers took over from there for the rest of the day. Wells Fargo (WFC) gapped DOWN at the open and ended the day with a 3.4% loss and a new 7-month low. The end result for the Financial Select Sector SPDR ETF (XLF) was a bearish engulfing pattern that started with a gap up to unyielding declining 50DMA resistance. I cannot see anything better than more churn ahead with the financials failing this important test of earnings season. My XLF calls went from near even to slashed in half. I only held on to see whether the financial earnings in the coming week can help salvage things.

The Financial Select Sector SPDR ETF (XLF) is stuck between slowly converging resistance from its 50DMA and support from its 200DMA. The bearish engulfing print warns of a negative outcome of the convergence.

The main positive from XLF is that, so far, it is surviving the critical test presented from the March 23 plunge toward 200DMA support that practically stopped on a dime.

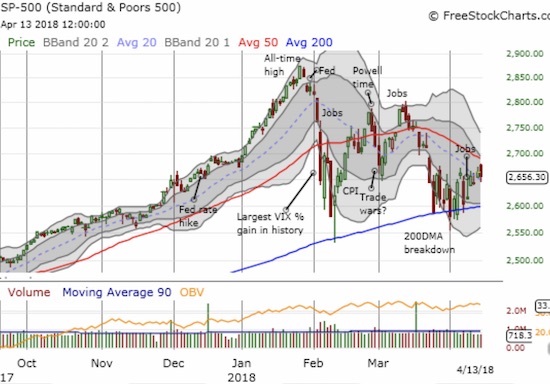

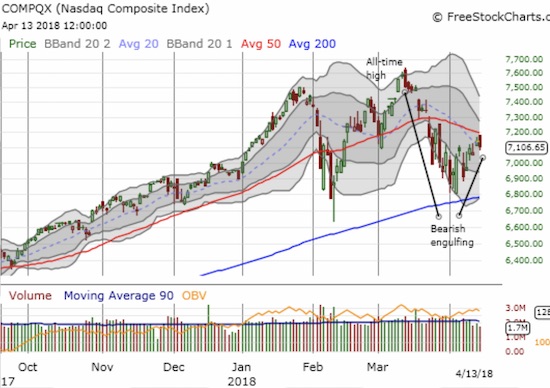

Tech stocks also suffered a bearish engulfing end to the week that confirmed powerful resistance at declining 50DMAs. Unlike XLF, the NASDAQ and the PowerShares QQQ ETF (QQQ) are still trading above the big up day on April 4 that seemed to confirm 200DMA support. In fact, an uptrend from those lows remains in place and a distinct V-pattern can provide some hope to bulls that a breakthrough can still happen in the near future.

The Nasdaq still has upward momentum from its test of 200DMA support despite the setback at 50DMA resistance.

The PowerShares QQQ ETF (QQQ) is in the same boat with the NASDAQ.

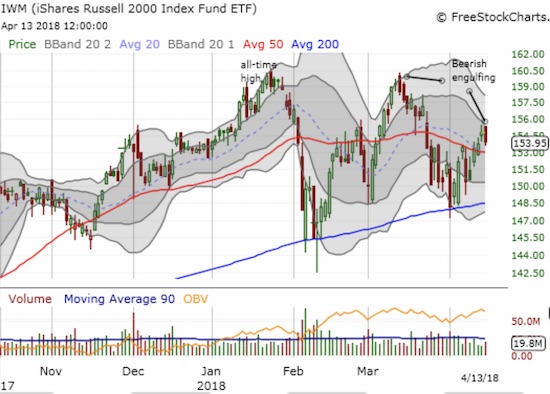

Small-caps are in the best position. A bearish engulfing pattern did not tank the iShares Russell 2000 ETF (IWM) back below its 50DMA.

The iShares Russell 2000 ETF (IWM) made a bullish breakout this week. A bearish engulfing conclusion to the week may have brought that bullish move to an end for now.