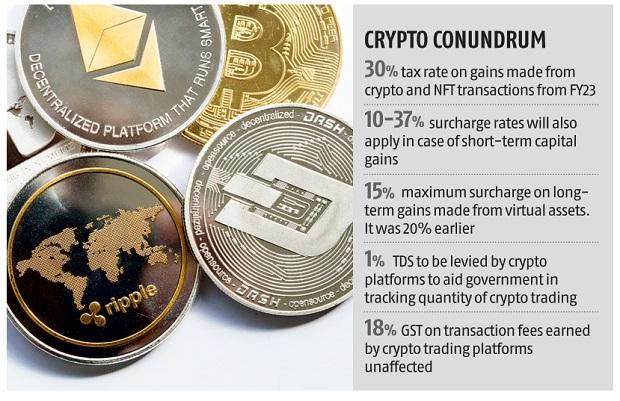

The Budget's move to tax gains made on crypto transactions by investors at 30 per cent has come as a respite for the country's crypto start-ups. This is because there had been fears that the government could ban virtual assets, which is now out of the equation, said founders of start-ups dealing in virtual assets.

Moreover, the announcement by finance minister Nirmala Sitharaman that the Reserve Bank of India (RBI) is going to come out with a digital rupee later this year is an encouraging signal. This will lead to a wider understanding and adoption of virtual assets in the country, according to industry experts.

“A 30 per cent tax on income from virtual digital assets, while high, is a positive step as it legitimises crypto currencies. It also hints at an optimistic sentiment towards further acceptance of crypto and non-fungible tokens or NFTs across stakeholders in the country.

The government has come a long way in its stance towards crypto from last February. We are confident that this will herald a new era of growth and innovation for India in the Web 3.0 world,” said Avinash Shekhar, chief executive officer (CEO) of crypto platform ZebPay.

“The announcement on the launch of a digital rupee using blockchain will familiarise Indians with the benefits and efficiency of virtual currency. It will build an appetite for crypto, blockchain, the multitudes of innovation and employment opportunities that these technologies are capable of fostering,” he added.

According to Nischal Shetty, CEO and co-founder of crypto exchange WazirX, many banks in the country had been unwelcoming towards settling transactions made on crypto platforms. “This is bound to change now as the banks were unclear whether the government may abruptly place a ban and as a result people could have lost their money. That is no more a possibility,” he said.

Shetty added that there is still some clarity required on how digital collectibles like NFTs will be taxed – whether the 30 per cent tax is only in the hands of a trader or would even artists who create and sell such assets need to shell out.

However, he lauded the introduction of a central bank digital currency (CBDC) and said that it would not only fuel the crypto economy, but also make the rupee an attractive international currency.

The government has sought to amend Section 2 and 22 of the RBI Act, 1934, to provide clarity that CBDC should also be regarded as bank notes.

The government has sought to amend Section 2 and 22 of the RBI Act, 1934, to provide clarity that CBDC should also be regarded as bank notes.

“Introduction of CBDC will give a big boost to the digital economy. digital currency will also lead to a more efficient and cheaper currency management system,” said Sitharaman in her Budget speech.

Many central banks of major economies are also exploring the possibility of introducing a CBDC.

According to Vishwas Patel, chairman, Payments Council of India, a digital currency will bring in transparency to transactions. It would enable accounting of all money, thereby reducing use of black money and cash-based transactions.

“The Budget made way for the digital rupee, which is a monumental step in driving the next phase of growth in the digitisation of financial services and payments in India. It will bring efficiency in transactions,” said Vijay Shekhar Sharma, chairman, managing director and CEO of Paytm.