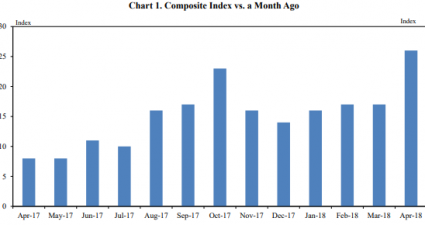

Kansas City Fed: Manufacturing Growth Strengthens In November 201

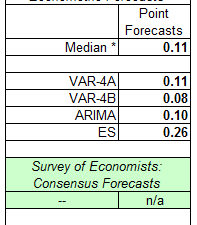

Of the three regional manufacturing surveys released to date for November, all show manufacturing expansion. The market was expecting a range between 4 to 7 (consensus 6) versus the actual at 7. A positive number indicates expansion. GROWTH IN TENTH DISTRICT MANUFACTURING ACTIVITY EXPANDED FURTHER The Federal Reserve Bank of Kansas City released the November…