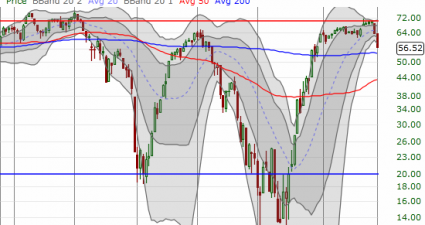

2014 Is Now The Worst Year For US Macro Data Performance Since 20

Once again the cyclical patterns in US macro data are re-emerging as extrapolated hopes fade into mean-reverting credit-impulse-hangover-driven realities. Despite all the hopes and dreams of escape velocity, cleanest-dirty-shirt-wearing economic enthusiasts, year-to-date performance of Citi’s US Macro Surprise index is at its lowest level since 2008. The worst performing US Macro data since 2008… Whether this…