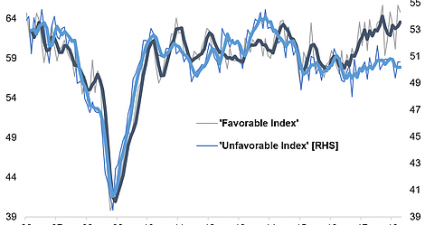

Chart: US Credit Managers’ Index

This week the attention falls on the popular Purchasing Managers’ Indexes (PMI) as just about every country in the world provides a timely insight into how their economy is tracking. But one report that often flies under the radar is the US Credit Managers’ Index (CMI) which provides an insight into the US economy and in particular –…