The Active Dominant Cycle: July 2 Major Swing Low

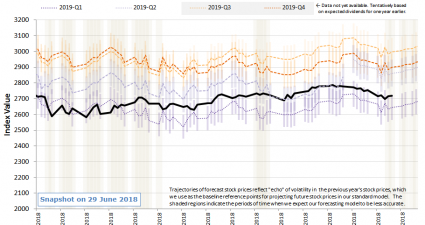

Review: From the June 4th Raj T&C Weekend Email (One month ago): “There is a cluster of 6-7 fixed cycles all due end June/early July that should be a major High or Low” Actual: The fixed cycles due end June/early July: the 80 CD Cycle, the 90 CD Cycle, the 95 CD Cycle, the 32-33 wk cycle, the 5 Month cycle and the 1308 CD Cycle are all due late June/early July should be a major swing Low…