Buy-Write Funds: Got You Covered

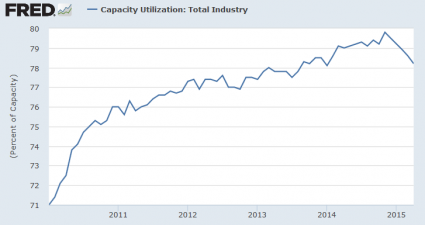

Fairly early in an investor’s development comes the lesson about covered call writing. The lecture usually sounds like this: “Income can be generated in a flat market by writing calls against assets held in portfolio.” Well, you probably noticed the domestic equity market has been churning on either side of unchanged over the past month….