Last week, used car prices had their biggest drop since 2009 – directly after the financial market meltdown of 2008. And right now, the auto market is showing signs of incredible worry.

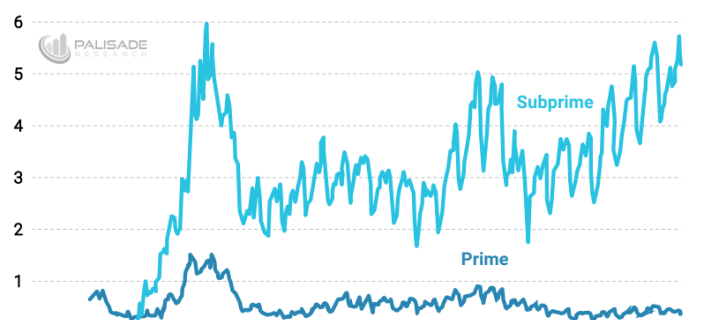

Delinquent subprime auto-loans are higher than they were in the last recession. Look for yourself. . .

What's interesting – and worrisome – is that consumers are defaulting on subprime auto loans when the economy is supposedly doing ‘very well'.

Like I wrote last week – there are cracks under the economy's foundation. And it's like a bucket of cold water in the face of the mainstream financial media that's pushing the ‘growth' story.

We must ask ourselves – “if things are going so well, why are subprime loan delinquencies at a 22-year high?”

I can't help but feel a bit nostalgic. This was the same situation that led up to the 2008 housing crisis. . .

First, there was massive growth in mortgage-backed securities and mortgage debt. Then, the Federal Reserve – led by Alan Greenspan – began aggressively raising rates after years of low rates. Soon after, subprime loans started blowing up – which trickled into the prime loans. And eventually, everything was in chaos.

Using the often-ignored Austrian Business Cycle Theory (ABCT) – coined by the brilliant economist Ludwig Von Mises – I am blaming the Fed for all this.

Thanks to the Fed, a near decade of zero-interest rate policies (ZIRP) and three rounds of Quantitative Easing (which totaled over $3.8 trillion in printed money) – the consumers' became hooked on cheap auto loans. . .

Their policies made the entire system fragile by getting consumers addicted to cheap debt through their easy money.

They then began tightening credit – crippling the borrowers.