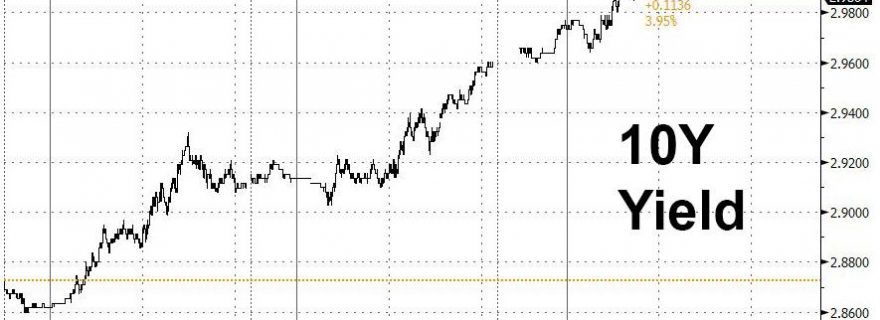

Global stocks stumbled on Monday ahead of an avalanche of earnings in this season's busiest reporting week but the big story overnight was the spike in 10Y Yield which climbed as high as 2.9957%, the highest level since January 2014, and nearing the psychological 3% level which has triggered market spasms and more than one tantrum in the past. The move was catalyzed by Treasury Secretary Steven Mnuchin saying over the weekend that he is planning a trip to China, an indication the US is considering a truce in its trade war with China.

Citi's technical team repeats the key highlights, pointing out that we're 1bp away from the psychological 3% level in the Treasury 10y yield. “The benchmark is trading at levels not seen since 2014, and we are continuing to make fresh YTD highs. The 10s now trade at 2.99% while the 2s10s trades on the 51 mark.”

If we break 3%, major levels come in here that extend up to 3.05%: this is the level where we have the 2014 high which is also the long term double bottom neckline and the long term channel top:

Not everyone is convinced that the 10Y will soar once it blows through 3% (especially not in a world which both the IMF and IIF said has record debt): “Ultimately it's hard to see a move sustained above 3 percent on the U.S. 10-year,” Mitul Kotecha, a strategist at TD Securities, told Bloomberg TV from Singapore. “Some of the dialing down in tensions, in risk aversion, may be having some impact there as well as expectations of continued strong growth in the U.S.”

Meanwhile, rising yields are capping other risk assets and the recent sell-off in Treasuries is being closely eyed by other markets, and supporting a pretty aggressive USD bid and VIX is rallying.

Meanwhile, traders are on edge because in addition to earnings – – traders also received the latest round of advance economic surveys that should show in the coming days if economic softness in the first quarter was just a passing phase linked to wintery weather and the Lunar New Year holidays in Asia. Readings from Japan, France, and Germany were all relatively reassuring. Japan's PMI data firmed as output and domestic demand picked up, France got help from its services sector, while Germany came in above forecast despite weaker new orders numbers.

“It's a good reading, it's still encouraging,” said Chris Williamson, chief business economist at IHS Markit, of the combined eurozone numbers, which he said pointed to quarterly GDP growth of 0.6 percent.

Helping the spike in yields is the recent sharp reversal/short squeeze in the dollar as the dollar; the BBDXY index gained a fifth day, rising 0.5% on Monday to the highest level since March 1, and is now up by 1.4% since Wednesday's close, the most on a three-day basis since December 2016. In addition to the squeeze of near-record dollar shorts, a “Europe-based trader” quoted by Bloomberg says dollar bids represent both unwinding of medium-term trailing stops and fresh positions, while another trader said that interbank names are seen selling the euro and the yen.

Elsewhere in FX, the EUR/USD slipped for a third day, down to a two-week low of 1.2226 while GBP/USD reversed an earlier gain to drop below 1.4000 handles as chances that the BOE may not move in May, together with renewed concerns over the Brexit front, weighed on pound sentiment. USD/JPY rose to trade above 108.00 for the first time since mid-February: option-related offers below that level capped for a while, before stops above the figure were filled. As Citi notes, some big levels have been broken in FX today:

It was a busy weekend in geopolitical news, with North Korea surprised the world on Saturday stating that it would immediately suspend nuclear and missile tests, scrap its nuclear test site and instead pursue peace and economic growth, a development which Trump quickly latched on to as evidence of yet another mission (nearly) accomplished. Additionally, talk of a trip by the U.S. Treasury Secretary to China also fueled hopes that the recent trade tensions between the world's two biggest economies may be thawing.