Job Openings Tumble By 176,000, Led By Food Service And Construct

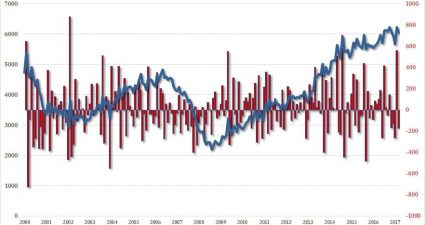

One month after the BLS reported that according to last month’s JOLTS survey, the number of job openings soared from 5.667 million, a six-month low which spooked analysts into wondering if the labor market is peaking, to 6.312 million, a 645,000 monthly increase and the second biggest monthly jump on record, the latest, just released JOLTS report…