Comprehensive Guide to VAT Prepared by Our Specialist VAT Accountants

What Is VAT?

Experts such as VAT Accountants will confirm that value-added tax (or VAT) is the consumption tax that is always imposed on products when the value is added from the manufacture up to the sale of the product. In some countries, this is referred to as goods and services tax or simply, GST. This tax is usually imposed directly in relation to the rise in the value of products or services at each production and distribution cycle. Hiring a specialist to manage this such as a VAT Accountant will depend on the complications involved in the collection and reporting of it in your country.

Essentially, it serves the purpose of compensating for the infrastructure and shared services provided by the state and funded by the taxpayers. This doesn't mean that it is charged on all goods and services. Duty-free items are mostly exempt or reduced for VAT and customs. Nevertheless, it is somehow regarded as the destination-based tax whereby the tax rate is usually based on the consumers' location and the sales price.

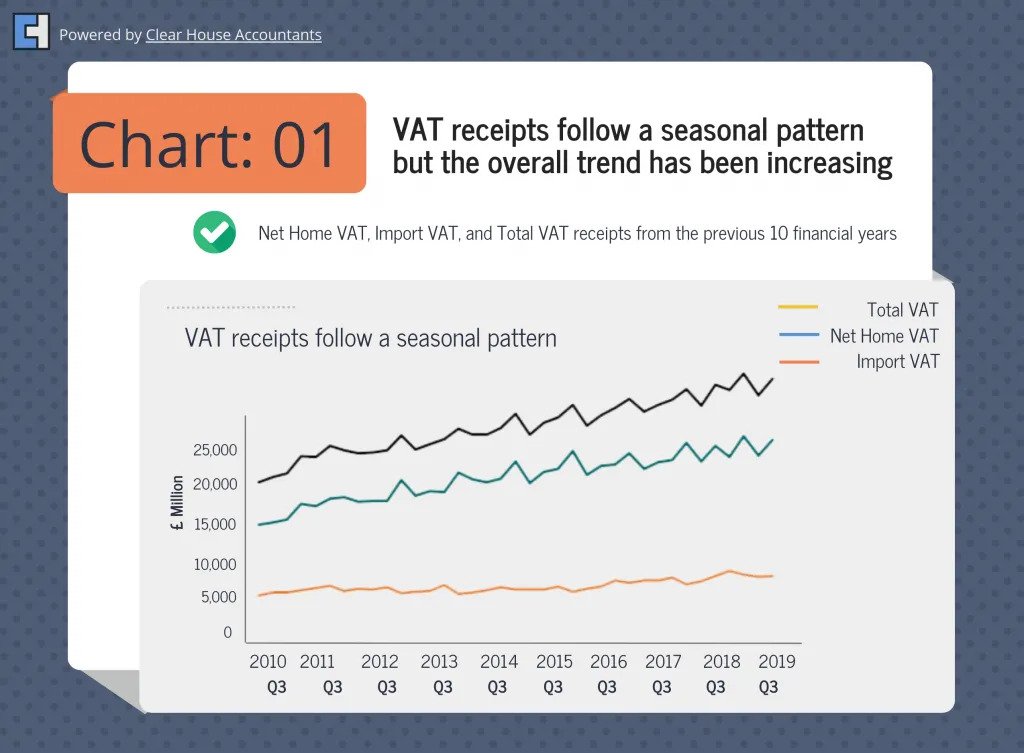

Statistics by the government clearly show an increasing trend in the collection of VAT receipts helping to raise a huge percentage of the total tax revenues in the UK. In the UK alone, it plays a significant role in generating the third-largest revenue for the government behind National Insurance and Income Tax a study carried out by the Institute of Fiscal Studies confirmed.

Source: www.gov.uk

As a business under the VAT threshold, you need to make sure you understand how it is applied to your products, your sales, and your purchases, speaking to a good VAT accountant and setting baseline systems to record, monitor and report VAT should be a very important step for your business.

Source: www.gov.uk

What Is the 2019 Value Added Tax Rate in the United Kingdom?

Despite the fact that the UK is under obligation to adhere to the VAT regulations laid down by the EU, it still has more freedom to come up with its own rates. This includes the upper or standard rate and the rest. But the only underlying condition attached to that agreement is that the rate should be more than 15 %. However, the suppliers and providers of products and services which are VAT registered have the obligation to charge the required rate, collect the tax and make the onward payments to the relevant tax authorities via a filing. The rates in the UK (as per 2019):

The UK VAT Rates:

- The Standard Rate: Its rate is 20% and is applicable to all other goods and services that are taxable in the UK.

- The Reduced Rate: At 5%, the Reduced rate is applicable for goods such as children's car seats, electricity, certain social housing, natural gas, some social services as well as district heating supplies for domestic use only. Under this rate, energy-saving domestic installations, LPG and heating oil for domestic use, repairs and renovations for some private dwellings, and medical equipment for the disabled is also covered.

- The Zero Rate: This rate stands at 0% and it covers printed books except for e-books, newspapers and periodicals, some social housing, renovations to private dwellings, household water supplies, collection of domestic refuse, basic foodstuffs with exception of pre-cooked food, take away food, prescribed pharmaceutical products, cut flowers, children's footwear and clothing, seed supplies and so on. Even though there are no charges on zero rates, the sale of goods and services under this category should always be recorded and the report prepared on the basis of your return.

You need to be fully aware of emerging changes in the rates especially when calculating the VAT. This is why it is recommended that you keep up to date with the information regarding the latest rates in order to ensure that your accounts and invoices are accurate. A VAT accountant can get complex, our trained VAT accountant are ready to help you with all matters Value Added Tax related.

Who Needs to Register?

Some running a business should be completely aware of Value Added Tax and the matters related to it. Things such as the Value-added Tax threshold, when to register for VAT etc.. Furthermore, you should consider not only compliance with VAT but the value it can add to your business.

At the moment, the value-added registration threshold in the UK starts from £ 85,000. This means that in case you realize that your business's yearly turnover is more than this threshold, you are obliged to register. Failure to do so in a period of 30 days will amount to a fine that you will need to pay.

This figure is likely to change from time to time. For example, it was at £ 83,000 in 2016 rising steadily from £ 77,000 (2012) and £ 64,000 in 2007.

To stay abreast with this vital information, you must check the threshold for each financial year to know how much you have to pay when registering.

Try and make effective use of accounting software to help you monitor your turnover in a bid to know when you are about to hit the threshold, it is advisable to use VAT Accountants who are fluent at the use of modern software and technology and specialise with Value added tax.

The Value-added tax turnover is calculated based on the rolling 12-month basis from any given point that is not based entirely on a calendar year. In short, when your turnover is more than the VAT threshold (say £ 85,000) you need to register. The decision to register for VAT can also be a voluntary one depending on the circumstances of your business. Otherwise, you must register for Value Added Tax when you:

- Buy, Purchase or get in control of a business which is already registered for VAT

- Sell products and services that are already exempted from VAT

- Will start supplying goods or services in the United Kingdom or will do so in the following 30 days.

Related: View 5 steps to prepare your business for VAT (Visual Infographic)

How to Register for VAT in the UK

Businesses can register online whether they are operating as partnerships or groups of companies. By doing so, you will VAT accountant and eventually create your VAT online account commonly referred to as the Government Gateway account. This account will enable you to submit your returns to the relevant authorities like HM Revenue Customs (HMRC).

You may also opt to use means other than online registration. In this case, you are obligated to do your registration by post through VAT1 except under certain circumstances such as :

- Applying for the registration exception

- Join Agricultural Flat Rate Scheme

- Registering business units or divisions of a given body corporate

However, when registering through the post, you will need the following forms:

- VAT1A for the EU business distance selling to the United Kingdom

- VAT1B for importing goods whose value is more than 85,000 from an EU member state

- VAT1C when disposing of any assets with which refunds (8th or 13th Directive refunds) have been claimed.

VAT Record-Keeping Requirements

Every VAT registered business must:

- Keep all records of purchases and sales

- Keep a summary of their VAT account

- Issue the right VAT invoices.

In addition, you must keep your VAT accountant records for a period not less than six years or ten years if you are using the VAT MOSS services. These records can be kept electronically, on paper or in a software program. Your records should be accurate, readable, complete and easy to understand. Records that you need to keep must include the following:

- Copies of the invoices you issue

- Invoices received

- Sell-billing agreements

- The names, addresses and VAT numbers of the self-billing suppliers

- Debit/credit notes

- Imports and export records

- Records of goods you can't reclaim their VAT on

- Records of received and dispatched goods

- VAT account on top of that, you need to keep records of bank statements, cheque stubs, cash books, till rolls and paying-in slips.

Related: Essentials of VAT record-keeping (Visual Infographic)

What Are VAT Returns?

VAT returns calculate the amount of Value added tax that a company needs to pay to HM Revenue and Customs (HMRC). In other words, the return calculates what you owe HMRC or vice versa. The amount depends on:

- The total sales and purchases in a 3-month accounting period

- The total amount of VAT you owe for all the sales

- The amount of VAT that you can reclaim for all the purchases

Tips About Submitting a Return

You need to submit your returns via the authorized HMRC approved Making-Tax Digital software. If your business is not required to get registered but you instead opt involuntarily, you can choose to submit your returns online manually. Most importantly, you need to be submitting your VAT returns once a year at least, after your accounting period. You can read our layman's guide to MTD here.

Deadlines for VAT

The deadline for submission is due on the first calendar month including the seven days duration following your VAT period end. Your VAT period end can be monthly, quarterly, twice a year or annually.

Making Tax Digital for VAT

In the UK, the Financial Secretary to the Treasury and Paymaster General made an announcement on 13 July 2017 informing the general public that the Making Tax Digital software for VAT would come into effect starting April 2019. Every business with a VAT turnover exceeding the current VAT threshold will have to:

- Ensure that their records are kept digitally

- Submit their reports on VAT return to HM Revenue and Customs (HMRC) via Making Tax Digital (MTD) software.

He further confirmed that Making Tax Digital will be made available on the voluntary basis to businesses for Income Tax and VAT.

Our VAT accountant are ready to help you prepare for MTD, we have worked with industry-leading software providers to prepare and provide you with MTD compliant software or bridging software enabling you to stay compliant with MTD requirements with no hassle or business disruption.

Source: www.gov.uk

How to find a good VAT Accountant

Finding a good VAT Accountant in the UK should not consume too much of your time. You can search for an accounting firm nearby, VAT Accountants or ask someone to refer a competitive Accountant. You also have the option to look for online accountants, various companies have listed their services but choosing the right one can be a daunting task. You may rely on referrals from other businesses or refer to customer reviews to shortlist a good VAT accountant. These accountants offer a wide range of services that are VAT-related starting from refund schemes to VAT exemptions all the way to transactional VAT advice.

Clear House Accountants are specialist VAT Accountants, we have an in-house team of specialists working with clients with a variety of VAT problems. Our smart and innovative solutions make sure our clients can have peace of mind in relation to VAT compliance while focussing on growing their business.