E

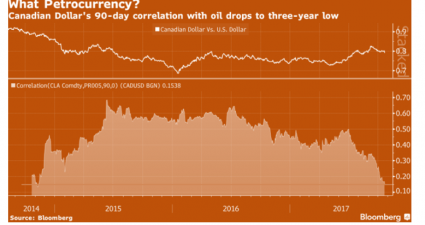

“The Canadian dollar’s link with crude has been falling sharply since the end of June, spurred by the central bank raising interest rates for the first time since 2010. The currency’s 90-day correlation with WTI crude is now at the lowest level in almost three years.” (Bloomberg News, October 24, 2017.) World oil prices have…