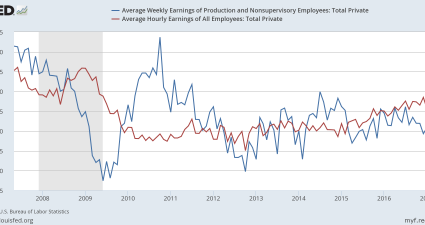

Less Than Zero: How The Fed Killed Saving

The other day I was in my local branch of a Too Big To Fail bank where I have a few accounts. One of them is a savings account in which I keep some of my “dry powder” cash stored. It had been a while since I had checked what kind of return the savings…