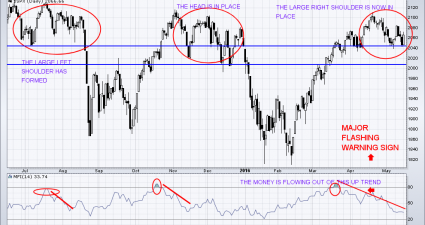

The ‘Tide’ Has Turned…Negative For Stocks

Currently, a ‘sharp fall’ is now anticipated within the equity markets! This decline will be accompanied with ‘new volatility’. There is a great deal of ‘uncertainty ‘within the U.S. markets. Currently, we are viewing a ‘textbook’ ‘head and shoulders pattern’ in the SPX and is going to be a big inflection point we look back on months…