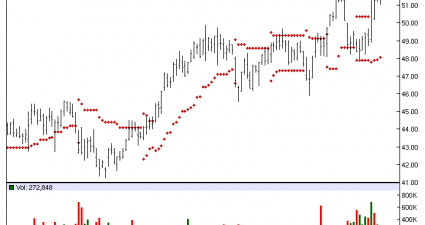

Kinder Morgan Stock Falling After Q4 Revenue Miss

Kinder Morgan Inc (KMI – Analyst Report) just released their fourth quarter fiscal 2015 earnings results, posting an earnings beat of $0.27 but a revenue miss of $3.636 billion. Currently, KMI has a Zacks Rank #3 (Hold), but it is subject to change following the release of the company’s latest earnings report. Here are 5 key statistics from…