5 Stocks To Watch Tomorrow – UA, MCD, CAT, AMZN, GOOGL

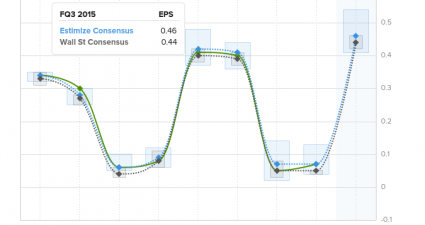

The deluge of earnings continues, with these five big names set to report tomorrow. Under Armour (UA) Consumer Discretionary – Textiles, Apparel & Luxury Goods | Reports October 22, before the open. Estimize is currently expecting EPS of $0.45, one cent higher than Wall Street’s consensus. Revenues are also slightly higher at $1.181B vs. the…