Chicago Fed Nat’l Activity Index: Oct 2014 Preview

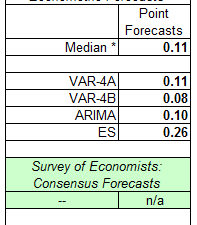

The three-month average of the Chicago Fed National Activity Index (CFNAI) is expected to decelerate to a +0.11 reading in the October update that’s scheduled for release on Monday (Nov. 24), based on The Capital Spectator’s median econometric point forecast for several econometric estimates. The projection is moderately below the +0.25 value for September, which…