So let us play a ‘what if'?

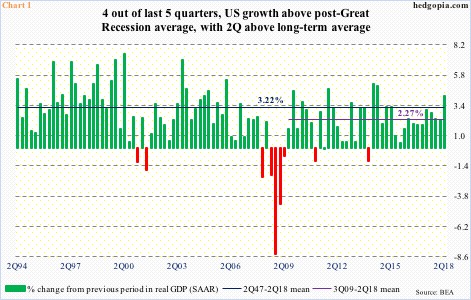

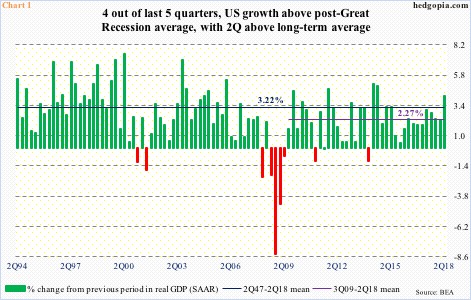

Real GDP grew 4.1 percent in 2Q18. This was the fastest growth rate in 15 quarters – above the long-term average of 3.22 percent going back all the way to 2Q47 and well above the post-Great Recession average of 2.27 percent (Chart 1).

It is only five weeks into the third quarter, but as of last Friday, the Atlanta Fed's GDPNow model forecasts another strong performance in the current quarter, expecting growth of 4.4 percent. Treasury Secretary Steven Mnuchin last week chimed in, “I think we definitely are in a period of four or five years of sustained three percent growth at least.”

The economy is in its 10th year of recovery. The unemployment rate dropped from 10 percent in October 2009 to 3.8 percent this May, which was the lowest since December 1969 (July was 3.9 percent). There is tremendous leverage in the system, and interest rates are not as accommodative as in the past. It is hard to convincingly argue for sustained growth of three percent for another four or five years. But what if the Treasury Secretary is right?

The unemployment rate is sub-four percent, yet 95.6 million Americans are out of the labor force. In June 2009, when the prior recession ended, this stood at 80.9 million. If jobs continue to be plentiful and those that left the labor force gradually start coming back in, the recovery does not have to die of old age.