Now you swear and kick and beg us

That you're not a gamblin' man

Then you find you're back in Vegas

With a handle in your hand

Your black cards can make you money

So you hide them when you're able

In the land of milk and honey

You must put them on the table, yeah

You go back Jack do it again

Wheel turnin' 'round and 'round

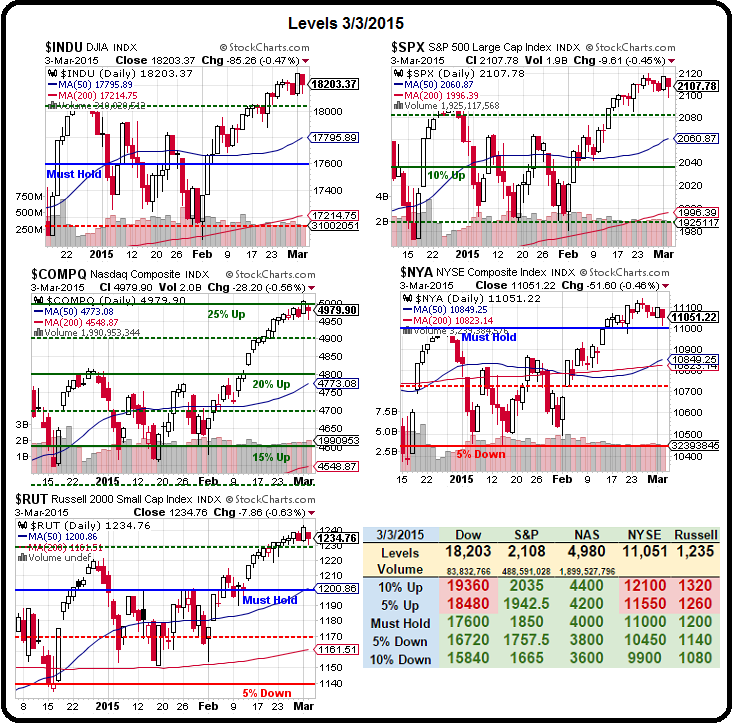

It's deja vu all over again as we're back to test the 2,100 line on the S&P, right where we were two weeks ago today when I said: “Yay, S&P 2,100! Now what?” At the time we were still shorting oil at $53.50 (now we're long at $49 (to $51) after a $4,500 gain) and we shared 4 bullish trade ideas that were all huge winners that morning so please, Twitterverse, stop calling us perma-bears!

NOW we are bearish (short-term) because NOW things are really topping looking and we reviewed our Short-Term Portfolio in yesterday's Live Trading Webinar and there wasn't a single bearish trade that we're regretting, so far.

Despite being “bearish” for the past two weeks, our Short-Term Portfolio still sits at $195,525, up 95.5% over 15 months. As I noted in yesterday's article on Portfolio Insurance, we are investing in hedges to protect the gains in our Long-Term Portfolio as well as giving us the courage to deploy more long-term money (12 times in Feb) as we turn up bargain stocks worth of investments.

Bargains like LL, which we just added to our LTP on Monday. As you may know, the company was attacked on 60 Minutes, which is on a network that I seem to remember seeing a few Home Depot (HD) and Lowe's (LOW) commercials on (in fact, here's CBS recommending LOW and HD the same week they attacked LL). Since we are Fundamental Investors who research the markets, we knew the attack was coming and we'd already decided to invest. In fact, last Thursday morning, we were discussing a possible investment in our Live Member Chat Room and I said: