The S&P 500 has gone up 5 weeks in a row, prompting some market watchers to anticipate a short term pullback.

Blind speculation is a poor form of investing/trading. It is very common for the S&P 500 to go up 5 weeks in a row.

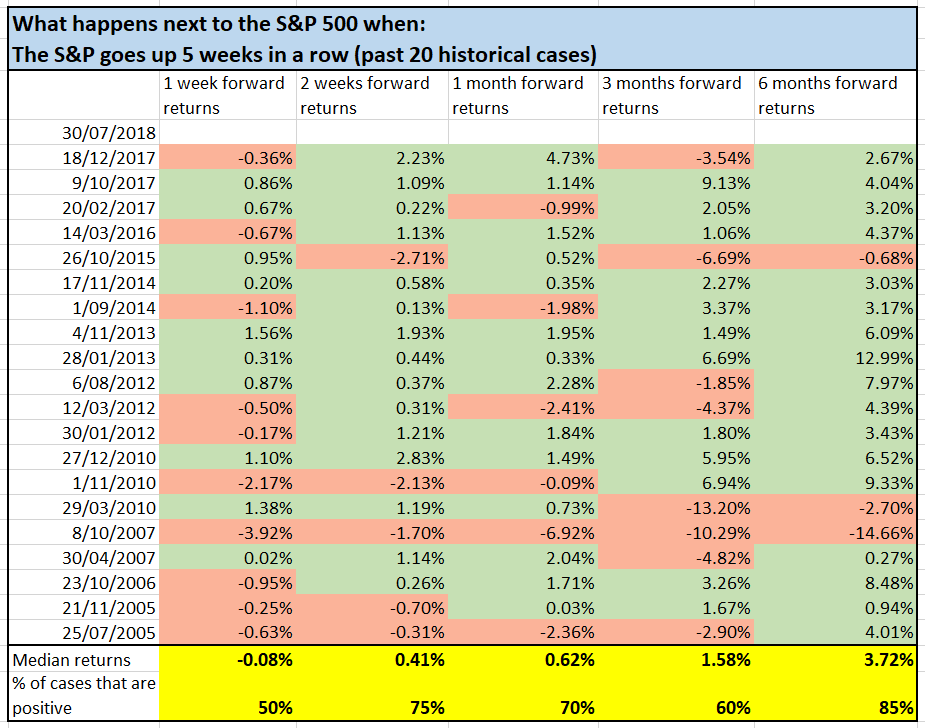

The past 20 historical cases demonstrate that this is not a short term bearish sign for the stock market.

Here's what happens next to the S&P 500 when it goes up 5 weeks in a row while it is above its 200 daily moving average (past 20 historical cases).

Conclusion

As you can see, the S&P 500 going up 5 weeks in a row has almost no impact on the stock market's short term. This is not a short term bearish sign.