Different week, same focal point for markets: it's all about trade.

Last week ended with a broadside from GM which, in comments filed with the Commerce Department, warned that tariffs could lead to u.s. job losses. On Saturday, Peter Navarro dismissed that as “smoke and mirrors.” Let's see what Trump has to say or, more to the point, let's see what @realDonaldTrump has to say.

There's still quite a bit of ambiguity around how the U.S. will approach limiting Chinese investment in U.S. industries. Last week was defined by mixed messages as Mnuchin and Navarro were trotted out on Monday to try and calm nervous markets. Wednesday morning brought what appeared to be a relent from Trump, but Larry Kudlow was quick to dismiss the notion that the decision to prioritize CFIUS (as opposed to leaning on the International Emergency Economic Powers Act of 1977) amounted to a less aggressive stance.

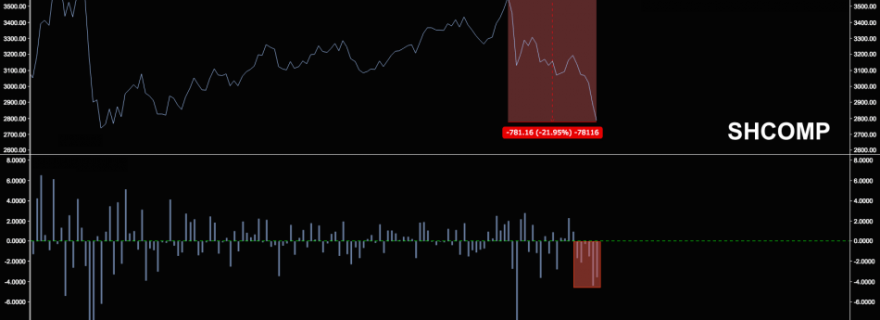

Whatever the case, Chinese assets are on edge. The SHCOMP fell into a bear market last week, as did H-shares and all anyone wants to talk about is the yuan, which is depreciating at a rate unseen since the 2015 deval.

Here's an annotated chart that shows you how things have played out for the yuan. Note the (successful) attempt to engineer a short squeeze last summer, the (initially) successful attempt to put the brakes on that by relaxing rules on forwards in September, the (not so successful) effort to put the brakes on post-September yuan strength by sidelining the counter-cyclical adjustment factor that was used to start last summer's short squeeze, and the recent weakness:

It looks like the PBoC wants to sit back and watch this, allowing the market-driven depreciation to cushion the blow from the trade tensions and then, when it runs “too” far, step in and intervene by selling USTs to arrest the slide. That would kill two birds with one stone: they'd get the depreciation and an excuse to sell/weaponize their Treasury holdings.

The pressure on the yuan is exacerbated by looser monetary policy. Remember, the Chinese economy is decelerating and a trade war threatens to exacerbate the downward trend in the activity data. As the economy continues to weaken, Beijing has shown a willingness to deemphasize the deleveraging push that threatens to choke off credit creation. That propensity to lighten up recently manifested itself in the PBoC breaking with recent precedent by not hiking OMO rates following the Fed. Last month's RRR cut was another dovish measure. Well, the more dovish China is compared to the Fed, the greater the policy divergence and that, in turn, puts pressure on the yuan.

Here's what Barclays had to say over the weekend: