For 2015… you get nothing!!

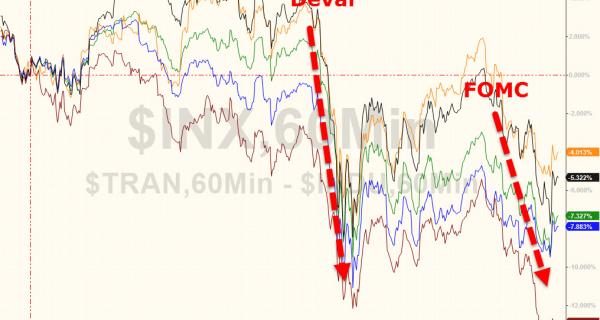

The quarter's carnage:

Not pretty:

But credit markets were a disaster:

HYG lowest since Oct 2011:

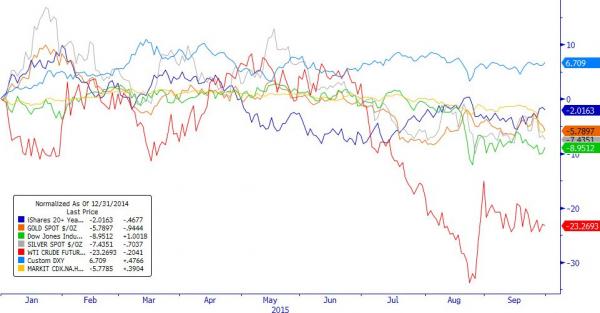

Commodities were mixed… Gold's worst qtr since Q3 2014, Crude down 24% in Q3, and copper's worst qtr since Q3 2011…

Year-to-Date – The USD is higher and everything else is lower, but bonds are the best of the bad bunch.

The Dow Industrials have now fallen for 3 straight quarters – the first time since Lehman, and only the 2nd time since 1978.

* * *

Back to the third quarter: Bonds dramatically outperformed in Q3.

Biotechs down 18.4% had their worst qtr since Q2 2002

Biotechs back into the red year-to-date…

With Utes the only sector in the green for Q3 and Energy the biggest loser…

* * *

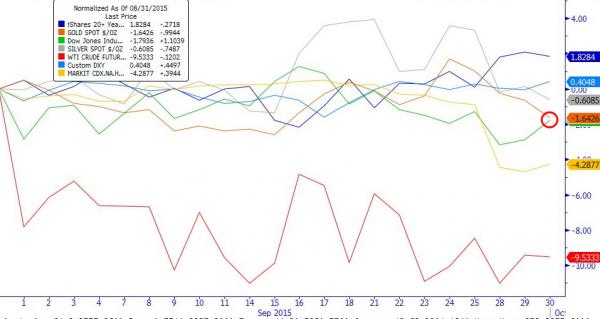

A Look At The Month…

Bonds outperformed…

Stocks were all red…

Commodities were mixed on the month with crude the biggest loser…

* * *

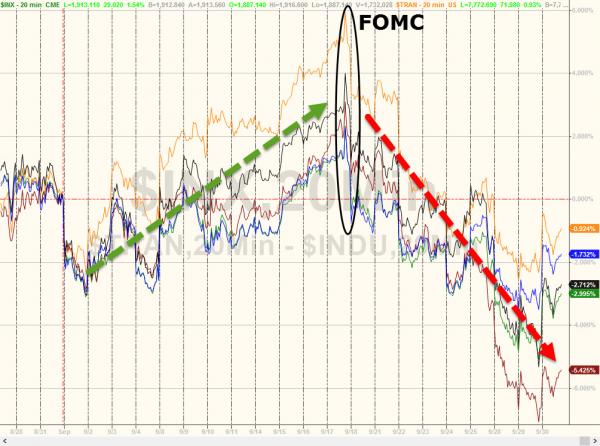

And Finally Today And This Week…

Given the major underperformance of stocks vs bonds this month (and quarter) it makes sense that flows would tend to drive stocks up as weights are equalized ahead of Q4… but note that this is not sustained buying pressure but simple allocations shifts at the margin..

Today saw month-end exuberance in most asset classes… The buying began after the close yesterday…Late-day panic buying ensued…